In some tax jurisdictions, you are required to use official Central Bank's foreign exchange rates. To complicate it further, you may be required to use a different date than the transaction date to get the rate ( 🇵🇱 👀 ).

Both are now possible in Capitally! Just type EUR.CB, NOK.CB or PLN.CB when selecting a currency and you will see all the numbers using the official rates.

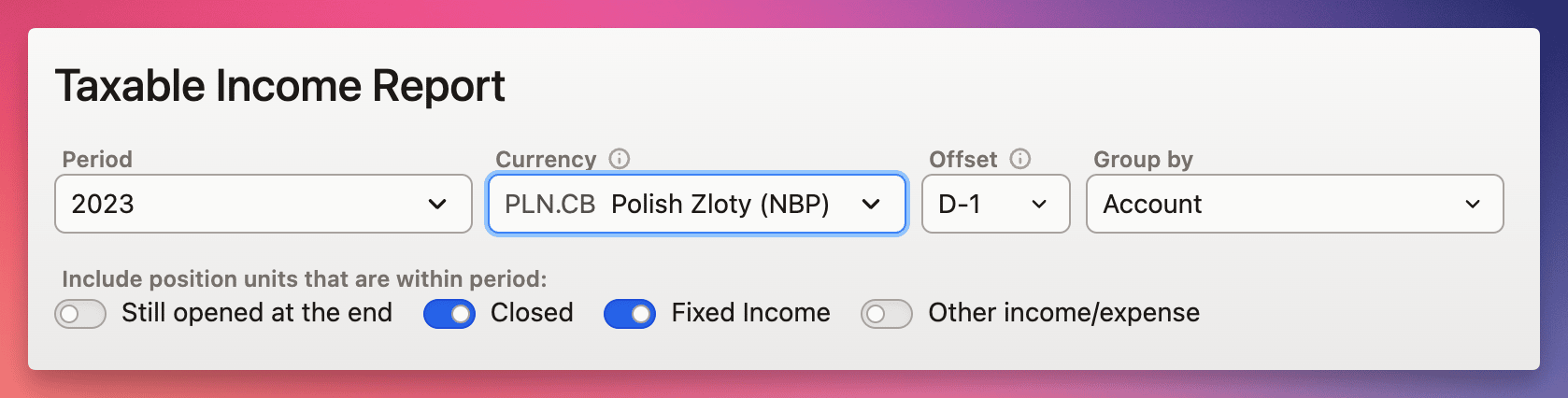

In the Taxable Income Report you can additionally choose the Currency Date Offset.