Find your way to Financial Independence

Portfolio tracker that helps you improve the performance of your investment strategy,

and achieve your life goals sooner!

Understand your investments, make informed decisions,

gain peace of mind

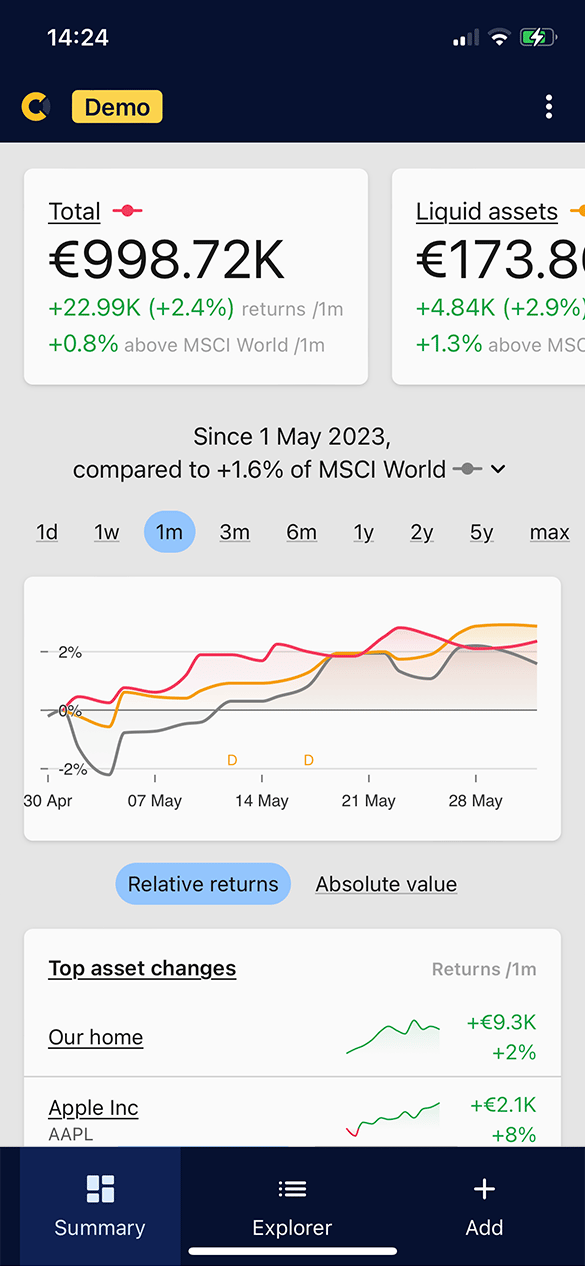

Net worth tracker

How much wealth do I have and how is it distributed?

- Aggregate all your accounts in one place

- Track all types of assets together

- Compare allocation across categories

- Observe how it has changed over time

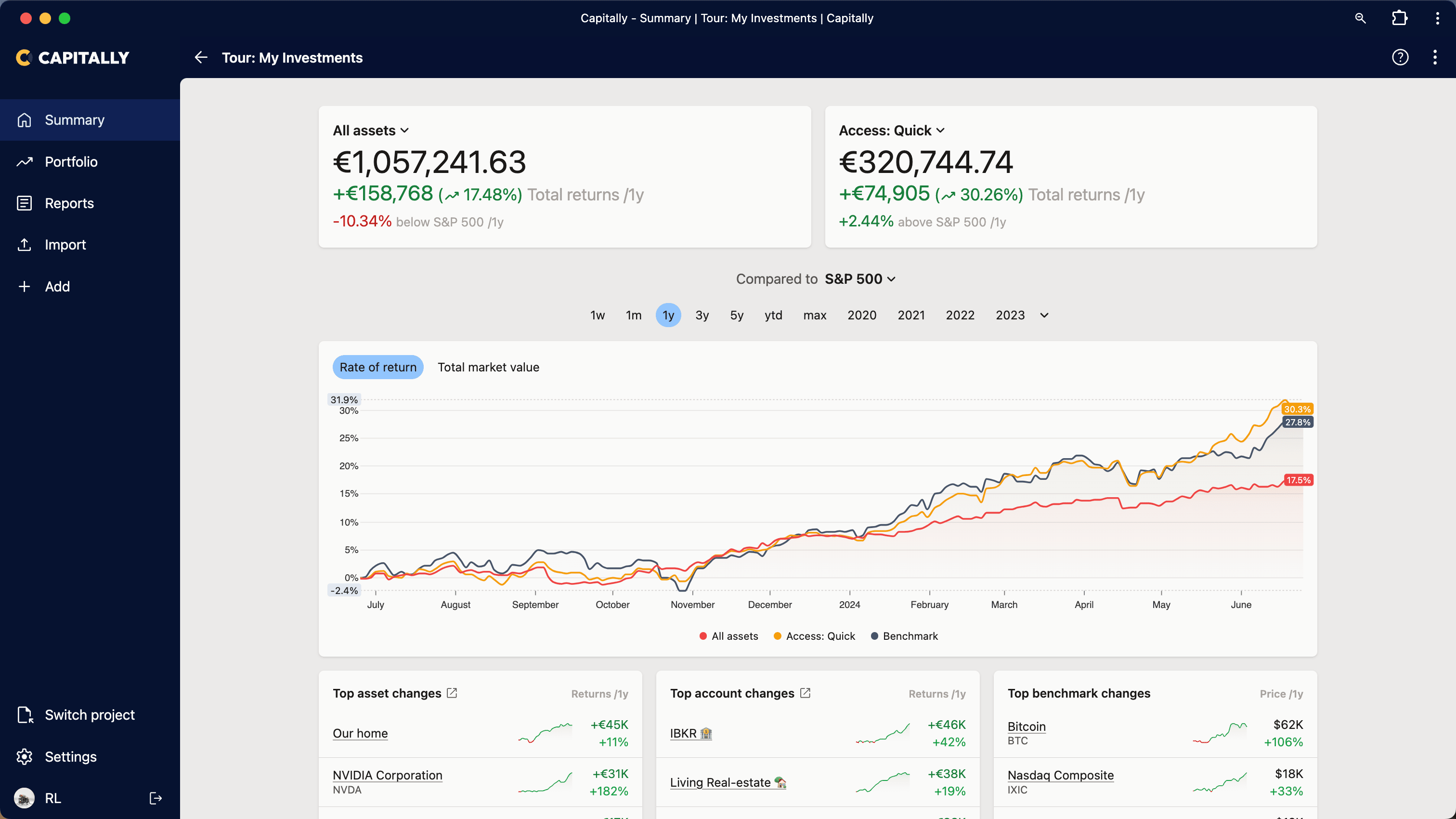

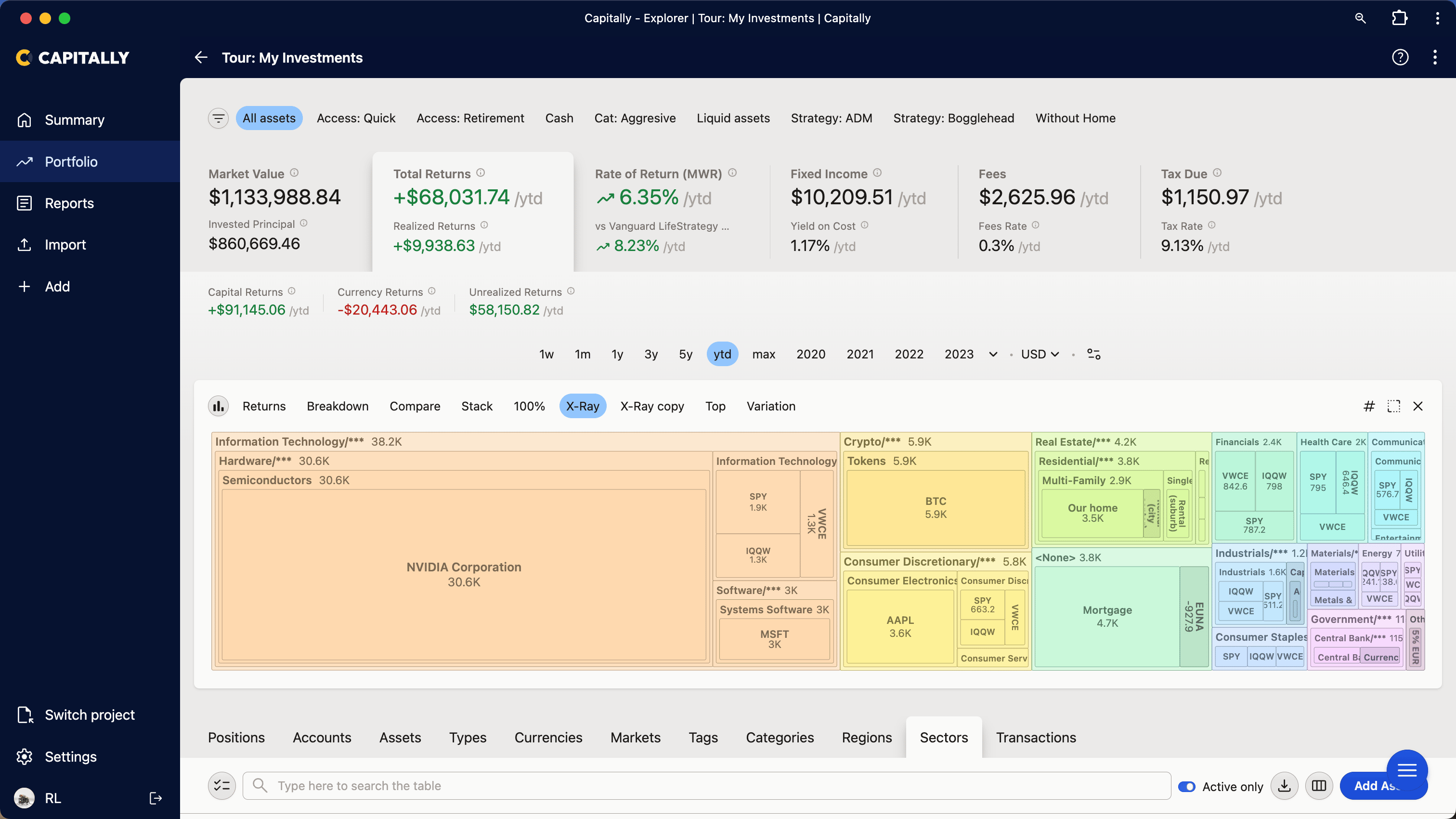

Stock portfolio tracker

How is my investment strategy really performing?

- Check your realized and unrealized returns

- Get your rates of return - ROI, TWR, MWR, or IRR

- Benchmark portfolio performance

- Analyze your investment fees and passive income

Dividend tracker

What is my investment income?

- Track upcoming and estimated dividends ahead

- Compare Dividend, Rent and Interest income

- See Yield, Yield on Cost and Growth at a glance

- Automatic reinvestment and DRIP schemes

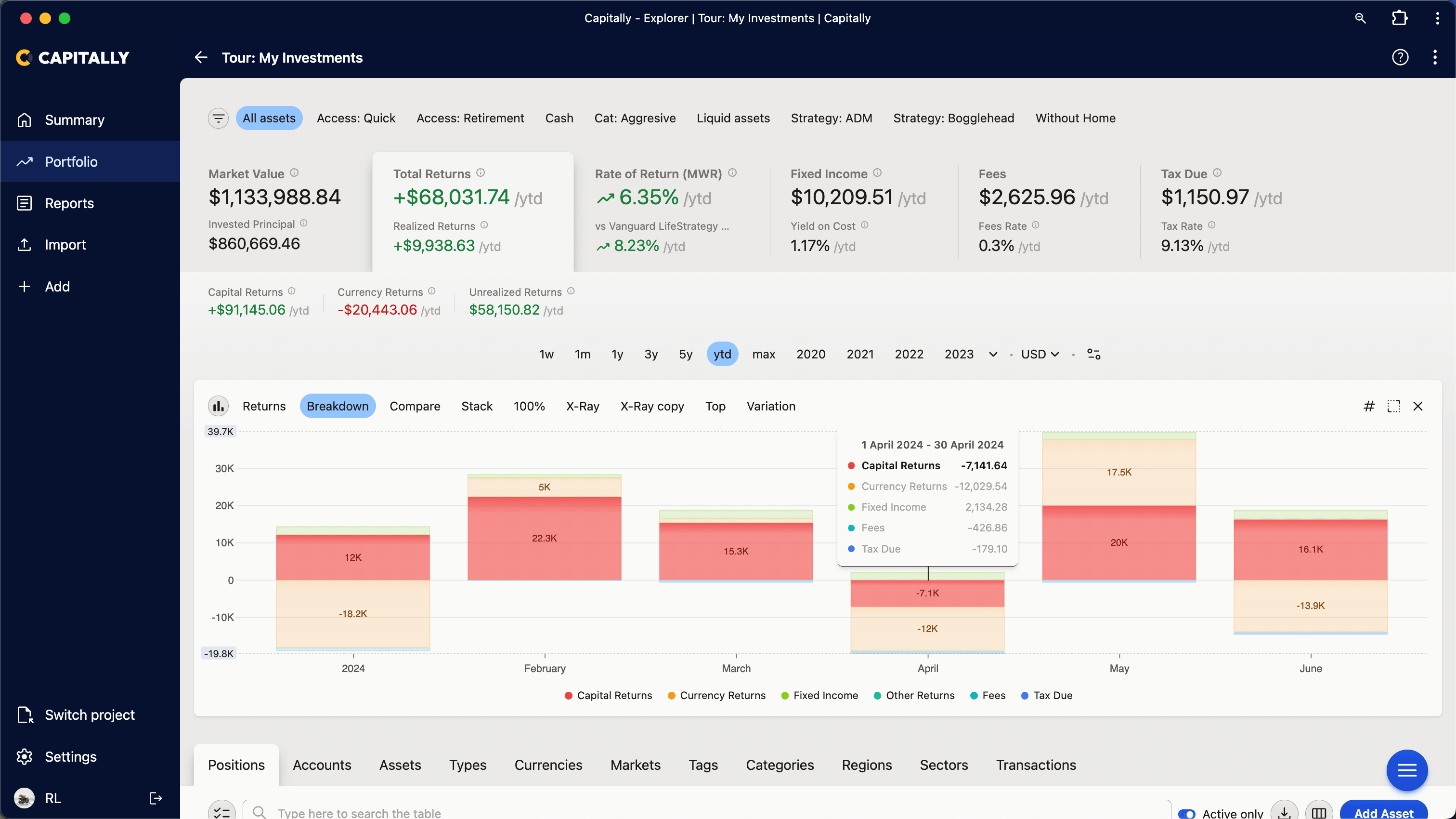

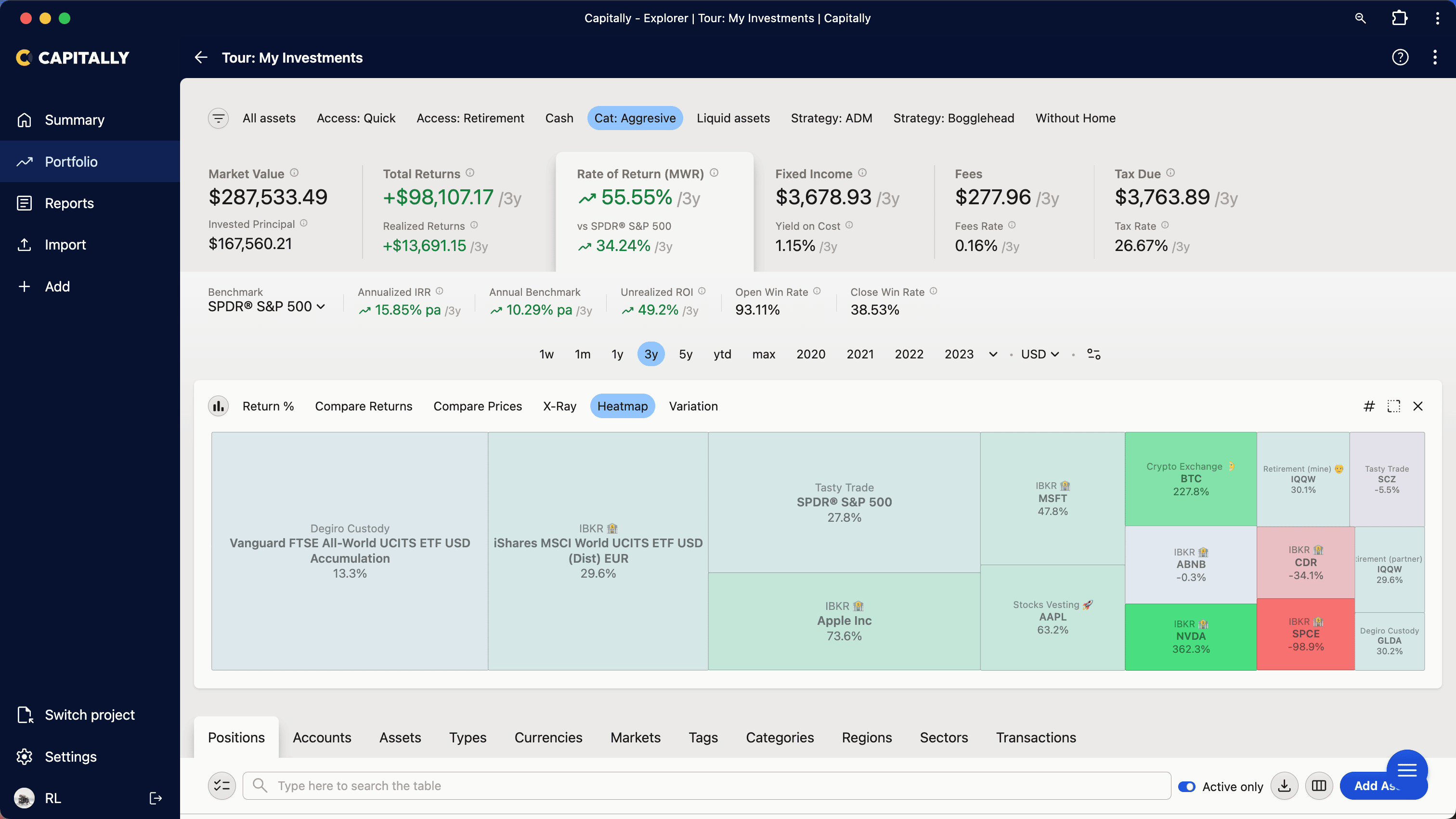

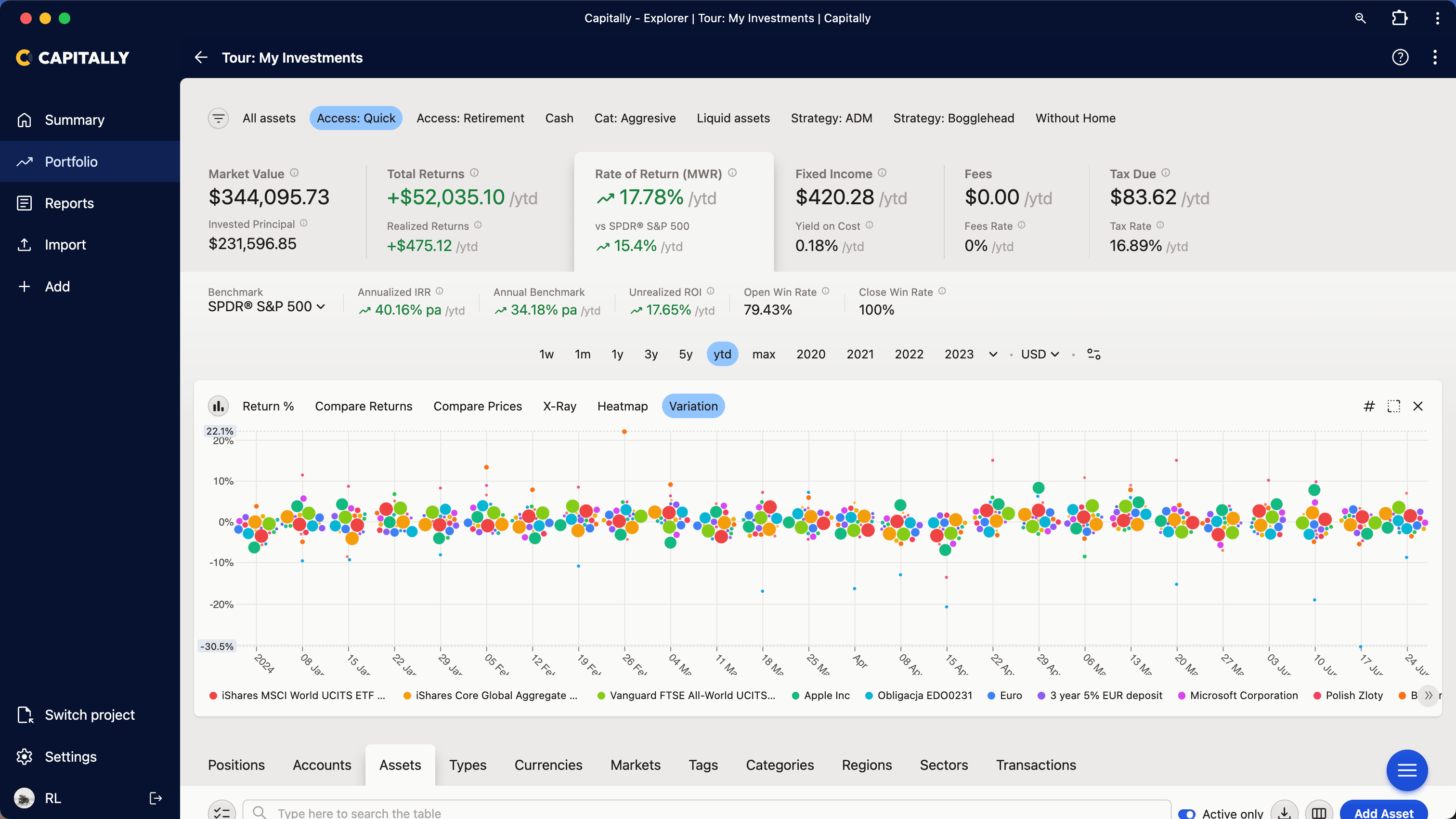

Portfolio analysis tool

Why did my returns decrease or increase?

- Identify what caused the largest impact

- Narrow down to a specific time period

- Compare assets, accounts, currencies, etc.

- Divide your returns into Capital, Currency, Dividends and Fees

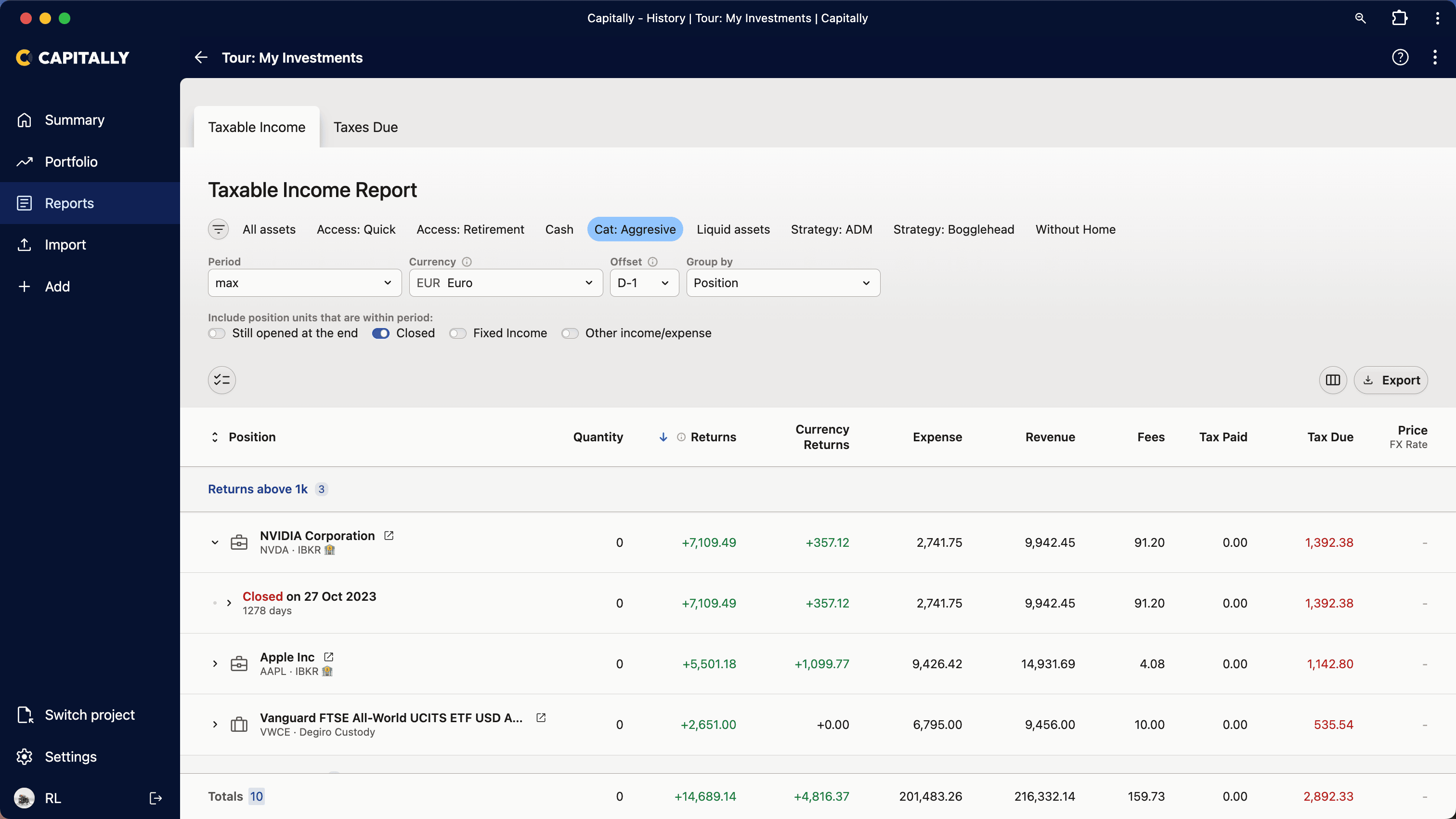

Capital Gains Tax calculator

How much tax will I have to pay?

- Get a detailed tax report in seconds

- See how taxes affect your return rates

- Check which losses are ripe for harvesting

- Use a builtin tax preset or create your own - regardless where you live you're covered!

All your investments in one place

Capitally is an open wealth tracker where custom data is equally powerful as the built-in one.

We believe that you should be able to include in your portfolio anything that you find valuable, now or in the future, so you won’t need that custom spreadsheet ever again.

- Support for almost 400 thousand indices around the world, including stocks, ETFs, crypto, options, and indexes

- Add your own assets and liabilities, such as real estate, mortgages, art, watches, collectibles, anything that can be priced

- Full support for multiple currencies

- Add all transactions or just update account balances

- Growing list of major brokers and apps to import from

- Import from any CSV or Excel file, or simply copy&paste

The only portfolio tracker where your data is only yours

We take your privacy seriously. In fact, we can't see your data, and neither can anyone else.

- Your financial data is end-to-end encrypted

- This is in addition to the standard security measures

- Hosted in Europe on Google Cloud Platform

- No 3rd-parties, no trackers, no ads, no upselling

- All your data is synced to your device

- You can import and export everything at any time

And it's much more than that!

- 🌈All types of assetsEasily track wealth across multiple asset classes – Stocks, ETFs, Crypto, Bonds, Real-estate, Art, Ventures, or any other custom asset.

- 📥Import from anywhereImport from dozens of brokers, or your own spreadsheets. All transactions or just balances.

- 💶Multiple currenciesTrack and view assets in any currency. See capital & currency returns separately.

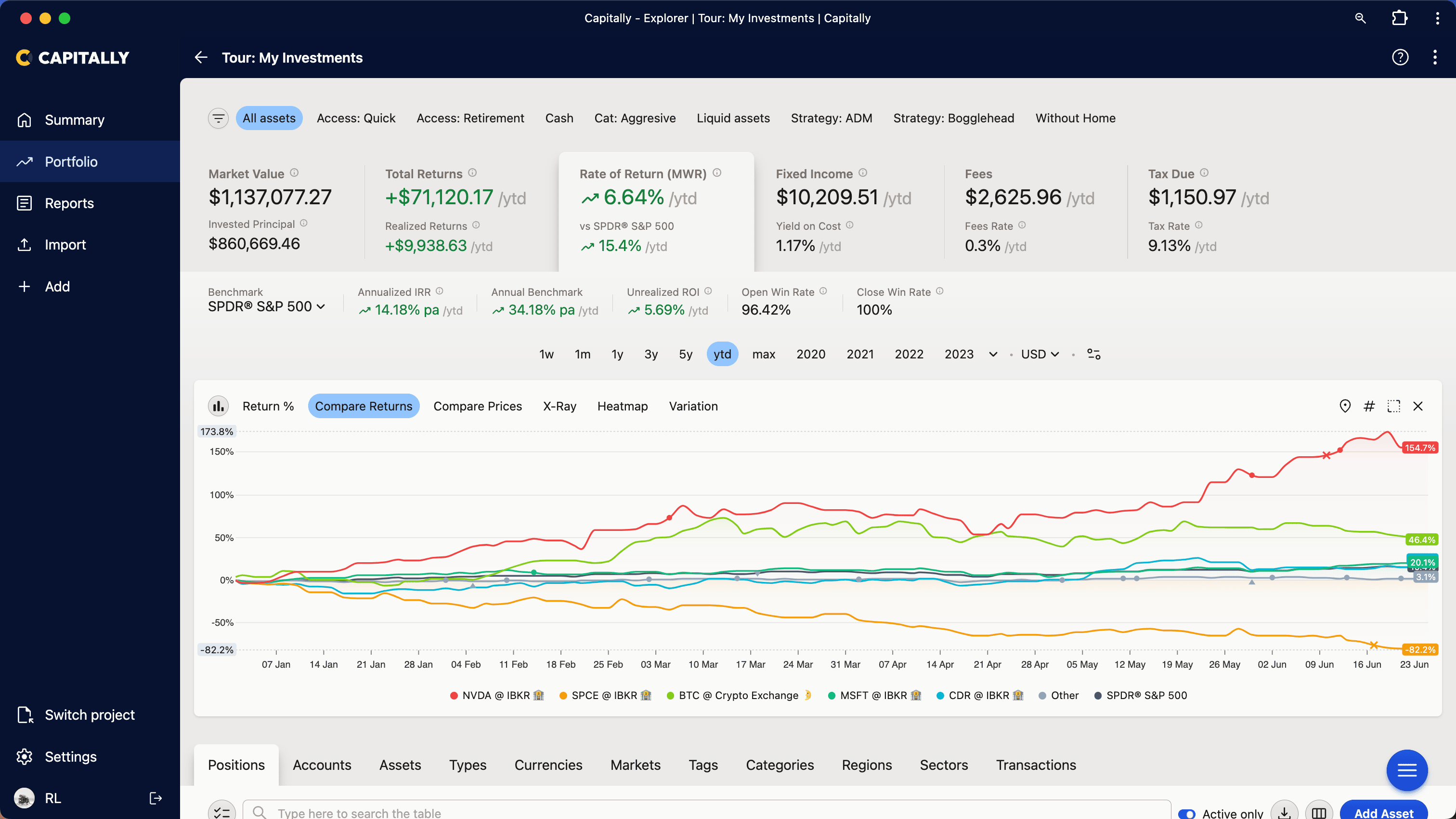

- 🧠Deep portfolio analysisDetailed portfolio metrics, like MWR, TWR, ROI, Dividend Yield, Yield on Cost, etc.

- 🏆Advanced benchmarksCompare your results with indexes, ETFs, custom assets or any part of your portfolio

- 🌎Exposure analysisSee your exposure to regions, industry sectors, and investment categories.

- 💰Dividend trackerTrack dividends, rent, interest or any other investment income. Complete with DRIP support and metrics.

- 🔮Income calendar & estimatesSee upcoming dividends or rent payments and estimate them years ahead.

- 🏦Liabilities, bonds and depositsModel mortgage payments, bond interest or P2P loans with dynamic terms and rates.

- 🤹Stock options trackerTrack stock options alongside the rest of your portfolio.

- 🛟Short positions and marginTrack short positions and sold options along with their margin requirements.

- 🏛️Capital gains taxesInclude taxes in your returns, do tax-loss harvesting and calculate your tax obligations at year's end.

- 🏷️Organize & filter your wayNest accounts, tag transactions, categorize assets. Then filter and group them however you need.

- 💄Extensive customizationCreate your own charts, filters, date periods, tables, importers, tax presets or even menus.

- 🧪Test investment scenariosCreate "what-if" projects to experiment with different strategies risk-free.

- 🥷On-device encryptionKeep data private with industry-leading encryption (literally the only tool to do that).

- 🚫No ads or 3rd-party trackersComplete privacy with no data sharing, unlike most investment platforms.

- 📱Fully-featured mobile accessTrack your investments on the go, on multiple devices at once. Even offline.

Created for people just like you

"Capitally is an absolutely great tool that allows you to grasp all your investments at a glance, thanks to its clear and well-designed appearance. At the same time, it provides practically unlimited possibilities for exploring data. The whole thing works equally well on a computer and a phone. As a user, I can count on excellent support (thank you!). I also like the pace of development and the features being added - since I purchased the license, the ability to calculate tax liabilities has been introduced, and I also have an early version of options support - something no other solution I know of offers. I definitely recommend it!"

Michał Szafrański

Bestselling author of "Finansowy Ninja"

"The X-Ray feature is “unbelievably good” - you are fantastic and really understand what users need."

Hemanth

India

"Once I got used to it, it's a great app! Especially as it handles all my assets - I've tested a few and they didn't have NewConnect for example"

Mateusz

Poland

"I'm really impressed by the quality and versatility of the app. I like that I can customize almost anything. I wanted to have a view of all of my family's assets in one place and the possibility to filter and organize data in any way I want, which is fantastic with the tags. The features that I love the most are the tags, the IRR data, the filtering capabilities and the X-Ray graph."

Boris

Canada

"I just wanted to share how brilliant your tool is for managing investments. It is so comprehensively thought-through and the ease with which it can be used is admirable. I used to actively manage my investments via Excel, but this helps to save a lot of time and effort. I'm very impressed!"

Kunal Parwani

Singapore

"I started building something similar for myself as a combination of Python + Excel and I came to the conclusion that it would be more economical to choose a ready-made option"

Tomasz Onyszko

@tonyszko

"Capitally is an excellent tool that provides a complete overview of all our assets, including real-time stocks, real estate, and private equity. It saves us a lot of time and effort compared to manually keeping track of everything. It's user-friendly and intuitive, with a fantastic support team that is always ready to assist. We highly recommend it to anyone looking for an efficient way to manage their investments."

F3 Capital

Investment Fund

"I like the simple UI, the DeGiro import worked pretty well, and I can track everything in my portfolio properly. Dividends and broker cost tracking work well, too."

Jamie Schembri

Netherlands

"It's really fantastic. I've started investing this year, and with Capitally I can see all the information that I need, and it's super easy to use. I love the dashboard and everything. Excellent idea"

Renan Dias

USA

"I had no idea how many poor investing choices I made before Capitally. Tax filing is so much easier now - saves me hours, and the tax-loss harvesting alone covers the subscription. What I love is how the app pushed me to learn more about metrics. This helped me make smarter money decisions. The tool is fantastic, and the customer support is even better!"

Paweł

Poland

"Love love LOVE Capitally! I work in Product and I really really appreciate your approach and just what an amazing product it is 😊 "

Li T

Australia

"I am already impressed by the product as it is now, while it is still in the early stages"

Maarten Bremer

"I spent 4 years building my 16MB Excel spreadsheet for portfolio tracking. In just two evenings with Capitally, I replicated everything and got even better analytics! The data visualization is incredible - slice and dice however you want. But what really blew me away was when the developer fixed an issue before I even reported it. This is next-level software and support! 😂"

TomeK Karczewski

Poland

"The game changer that Capitally brings is that it has a very high degree of customization when it comes to selecting assets and recording transactions. For me the differentiator is the ability to record transactions in a currency that differs from the asset currency. My investment portfolio spans multiple global markets and accounts and normal portfolio tracking tools just don't recognize the fact that I may be purchasing a given equity in more than one currency in different accounts."

Stuart Davidson

USA

"I tried Portfolio Performance, but quit it multiple times because of errors in currency handling, importing is too clunky and error-prone in general and there’s a lack of automatic adjustments for dividends and splits. Capitally does all these things right and the reporting is visually nice and quick."

Andries Zwikstra

Netherlands

"Really pleased to be part of Capitally’s clients! Love the fact that it brings so many functionalities within an efficient interface. Every time I think of something I'd like to do or a piece of data I'd like to have, I always find a way to get it. It's amazing! I’ve also added a shortcut on my iPhone’s home screen, so I can easily access all my data even when I’m away from home. Perfect!"

Frank

France

"I currently have an active subscription with another tool, but I already know that I won't be renewing it.

Capitally takes data exploration to a whole new level, despite lacking some functionalities that will probably appear over time. Both as a programmer and a user, I love tools where intuitiveness is a high priority."

Paweł Gajda

Poland

All-inclusive Pricing

It’s the beginning of something bigger

While Capitally is a very capable investments tracker, what we really want is to make sure that you can choose the right investing strategy and stick to it. Sound plan and consistency are key for long-term investments, and we will help you achieve it with upcoming updates.

Hey 👋 I am Rafał,

the brains behind Capitally. For me, being independent is all about living, working, and relaxing at my own terms. It's the liberty to pack my bags and travel whenever I desire, or to immerse myself in whatever piques my interest.

There's a myriad of paths to this freedom, and long-term investing is often one of the critical parts. But let's be honest, it's far from a one-size-fits-all situation. Everyone's journey is unique, and finding a financial strategy that will serve you well over time requires a solid base of understanding.

I've explored a bunch of tools out there meant to make this process easier, but I found them too restrictive, disconnected, leaving me filling in the gaps with ever-expanding spreadsheets. That was, until they simply couldn't keep up anymore.

That's when it hit me - why not create a tool that combines the flexibility and openness of a spreadsheet with the power, and user-friendly interface of an app? A tool that empowers you to devise, execute, and track YOUR strategy towards financial independence? Capitally is the answer to that.

Frequently Asked Questions

At Capitally, we believe that investment tracking is just the beginning, not the end. Yes, it's essential to keep an eye on your investments, but it's equally important to understand them in the context of your overall investment strategy.

Our goal is to assist you in not only finding and implementing your investment strategy but also maintaining it over the long term (we're still working on this aspect).

When it comes to tracking, we have a slightly different take on a few things:

You have the freedom to track either broad account balances or detailed transactions - the level of detail is entirely up to you.

Custom assets can be tracked just like standard ones, complete with price history and transactions.

You can import data from any table, whether it's an export from your broker or a spreadsheet you've created.

Your data is encrypted and stored on your device - it's yours, and you can export it all at any time.

You can find more information about these features in other sections of this FAQ.

Capitally is designed with long-term investors in mind, particularly those who have or are planning to build a diversified portfolio across various assets and brokers.

If you're someone who has previously managed your finances using a spreadsheet, you'll find Capitally to be a familiar yet enhanced experience. It's specifically designed to excel at analyzing the historical performance of your investments, making it a significant upgrade from your typical spreadsheet.

We don't sell or analyze your financial data or behavioral patterns. Our focus is solely on delivering the best user experience, which involves analyzing the general adoption of features and application performance, all in accordance with our Privacy Policy.

In fact, your financial data is encrypted on your device using a private key that's derived from your password. This means that only you can decrypt this information. Neither we nor anyone else can access this data, even if we wanted to.

This ensures that even in the unlikely event of a security breach or if one of our contractors acts inappropriately, the data that could potentially be extracted from our systems would be useless. This is a level of security that sets us apart from our competitors.

Additionally, we adhere to industry-standard security best practices:

We utilize a trusted computing platform (Google Cloud).

All server communications are encrypted with HTTPS.

All data is encrypted at rest.

Access to data is granted on a need-to-know basis and is logged.

We implement robust security measures to keep our systems secure.

For a more detailed explanation of our encryption mechanism, please refer to our security guide.

Capitally is a subscription-based service and we currently do not offer a Free tier. Instead, we have a 14-day fully-featured Free Trial that doesn't require a Credit Card, so you have ample time to check if it works for you.

As we continue to add more features and enhance the application, the subscription prices will increase and additional plans will be introduced. The good news is, by subscribing early, you can lock in the price from the day you subscribe.

Want to stop your subscription? No problem! You can cancel anytime and still use everything until your paid time runs out. Changed your mind later? Just turn it back on!

Don't worry about your work - if your subscription ends, we'll save all your data for 6 months. This means you can come back anytime within that period and pick up right where you left off. If you prefer to have your data deleted sooner, just drop us a message at support@mycapitally.com and we’ll take care of it.

Here's a nice bonus: staying subscribed locks in your current price. Even if our prices go up later, you'll keep paying the same amount you started with. (Just remember - if you cancel and come back later, you'll need to pay the new rates.)

Want to switch to a different plan? You can do that anytime too! Here's exactly how it works:

We'll look at how much you've already paid and haven't used yet

This amount becomes credit towards your new plan and future payments

You'll only pay the extra difference

So when you downgrade to a cheaper plan you won't need to pay anything until your credit runs out.

The money you already paid never goes to waste - it just moves to your new choice! 🙂

Capitally is a truly global platform, with no territorial limitations. We support all national currencies and major markets worldwide.

Even if we don't have data for your local mutual fund, don't worry - you have the option to add it yourself. We've specifically designed Capitally to be inclusive and accessible to everyone, everywhere.

Capitally offers a high degree of flexibility when it comes to tracking assets, and we have plans to expand this even further. Our goal is to create a tool that allows you to analyze all aspects of your wealth, including liabilities.

At present, we directly support:

Stocks, ETFs, Currencies, Cryptocurrencies, Commodities, Indexes - check out the full list of all markets for which we provide pricing and dividend data.

Cash accounts in any national currency.

Real estate and startup ventures.

Art, watches, antiques, cards, and other collectibles.

Bonds, deposits, and other fixed-income instruments - currently, these are priced manually, but automated support is on our roadmap.

For each type of asset, you can track individual transactions or just current balances, along with historical market prices.

The answer is both yes and no. There are essentially two types of trackers:

Balance trackers: These focus on your current wealth distribution and how it has changed over time. They're quick and easy to use, but they might not provide the level of detail you need, for example to analyse transaction costs, or do taxes.

Transaction trackers: These provide a more detailed and accurate picture, but they often require a lot of manual input, which can be time-consuming.

Capitally offers the best of both worlds. You can quickly update account balances for a high-level overview, or add individual transactions for more accuracy. You have the freedom to mix and match as you please, and you can even switch your tracking style at any time.

Capitally features a robust importing interface that allows you to easily upload CSV or XLS files from any broker or app that provides transaction history or account balances. You can even copy and paste data from your own spreadsheet if you have one.

We currently support a growing list of brokers natively, including Interactive Brokers, Degiro, TastyTrade, Schwab, Coinbase, Kraken, and XTB, among others.

For individual transactions, you can simply add them manually. If you're only tracking account balances, you can update them directly in the table, along with the current market price.

While many trackers use services like Plaid to automatically synchronize account balances, these often require you to provide your bank login details and may not always be accurate. They typically only provide account balances and sometimes up to 3 months of transactions. If your broker isn't supported, which can often be the case depending on your location, you're usually left with the tedious task of manual input as most trackers don’t support bulk import well.

At Capitally, we prioritize your privacy and aim to give you more control over your data. That's why we're focusing on perfecting CSV imports first. Eventually, we plan to offer automated synchronization as well, so you can enjoy the best of both worlds.

Absolutely! We automatically include dividend payouts for any eligible stock market assets you've added, including both stocks and ETFs. Please note that these may differ from what your broker reports due to taxes and transfer delays, but you can easily verify and correct them if necessary.

Not only that, we allow you to recognise and compare fixed income from other types of investment, like Bonds or Real Estate Rental.

What are you waiting for? Start optimizing your investments today

- Works great on a desktop or laptop

- Fully featured on mobile

- Add to home screen for quick access and security