Properly organized portfolio let's you see everything that matters at a glance and makes navigating it a breeze. There are various ways to do it, and we'll go through them one by one.

Don't worry about figuring out the perfect structure before importing your data. You can make changes and adjustments over time. However, it's best to import transactions to accounts from the very beginning. If you use the built-in broker imports, they will automatically create accounts for you.

Organizing in Bulk or One by One

All of the properties mentioned in this article can be set when creating or editing an account, asset, or transaction. You can also change them in bulk by selecting multiple rows in the appropriate table and changing the property on all objects at once.

Assets

Just like in real life, you can have the same asset in multiple accounts. For example, you might have US dollars in your bank account and also in each of your brokerage accounts. The same goes for stocks and ETFs.

Therefore it's best to use the same asset across multiple accounts whenever possible. Try to use a predefined asset (one you can find in our database by searching) instead of creating custom ones.

This way, no matter where the asset is, it will have the same price history, tags and taxonomies. By opening the asset, you will also see all your positions across accounts.

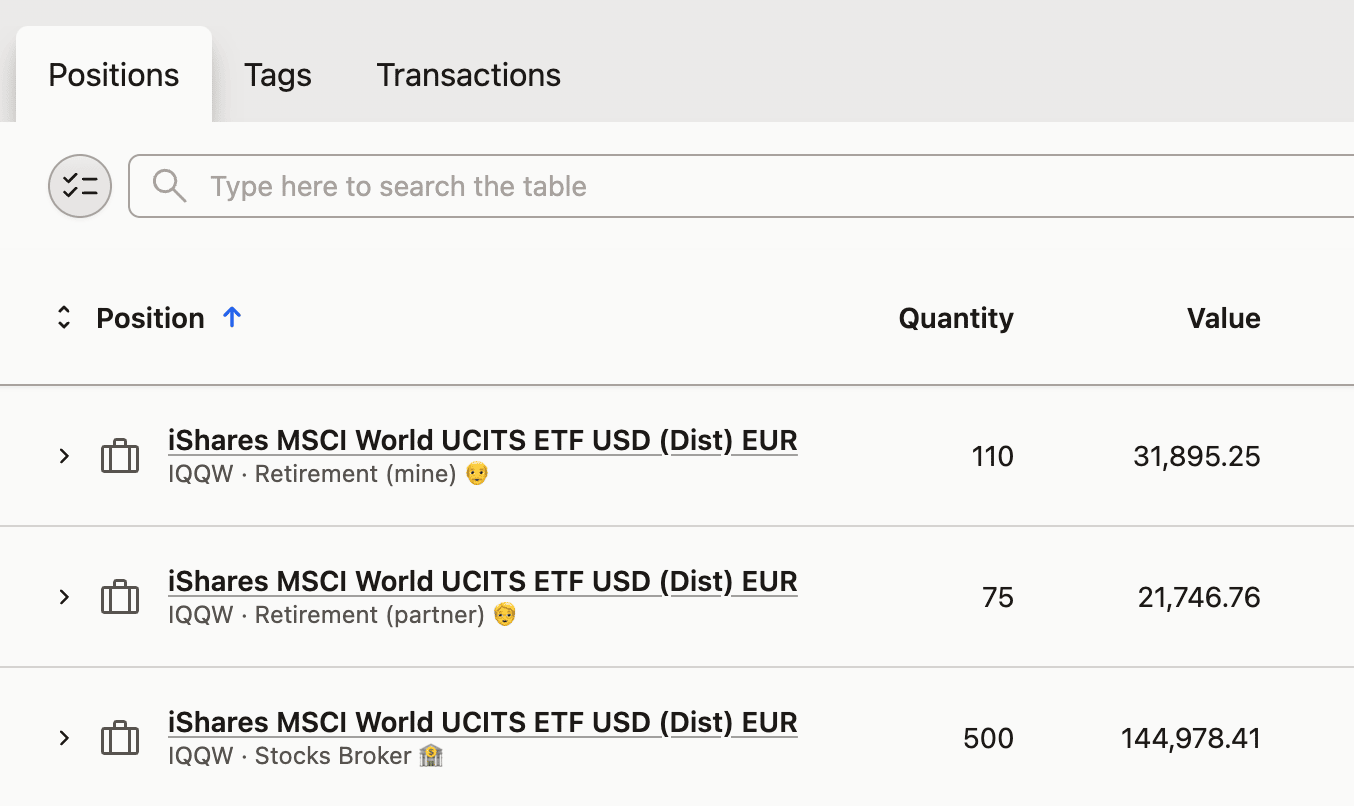

All positions of IQQW across three different accounts

All positions of IQQW across three different accounts

Accounts

Ideally, accounts in your portfolio should have a 1:1 relationship with your real-life accounts. This way, you will know instantly where your assets are.

If you have two accounts with the same broker — a retirement account and a regular account — you would create two separate accounts in Capitally to record your transactions.

To move positions between accounts, you can either:

set the account in specific transactions one-by-one,

select multiple transactions and move them in bulk,

move whole positions by selecting them in the

PositionsorAccountsviews.

Bank Accounts

If you have a bank account with multiple cash accounts, your bank account would be the account in Capitally, while the cash accounts would be represented as cash balances on that account in their respective currencies.

However, if you want to track more than one account at the same bank with the same currency, you will need to either:

Create a separate Account and add the currency balance to it

Create a custom Cash or Deposit asset and add its balance to the bank's account

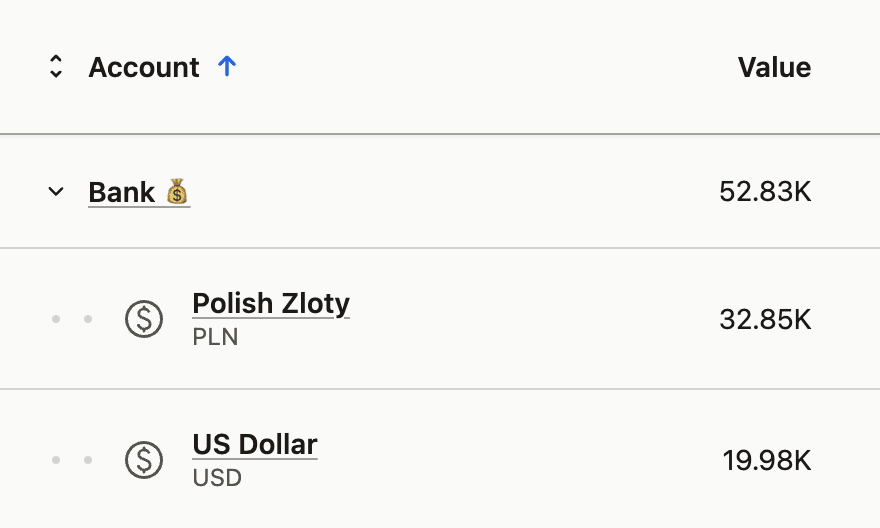

Cash balances of a single Bank Account

Cash balances of a single Bank Account

Other Types of Accounts

You can create as many accounts as you wish. For example, you can have a single account for all your real estate holdings or create separate accounts for each property (which is helpful if you want to group a property with its mortgage).

In general, it's best if all transactions are associated with an account.

Account Folders

As your portfolio grows, you'll likely have many accounts. You can organize them into folders, just like you would organize files on your computer's desktop. If you have multiple accounts with the same broker, you can group them together under the broker's name. If you have accounts with multiple brokers, you can group them together under a "Brokers" folder. And so on.

Folders can be nested. For example, if you have multiple accounts with Degiro, you could put them into a "Brokers/Degiro" folder.

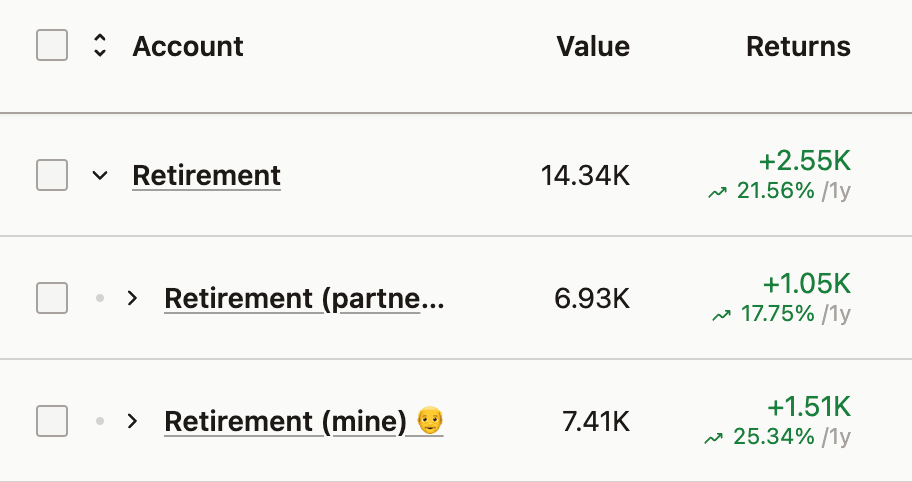

Using "Retirement" folder to group retirement accounts

Using "Retirement" folder to group retirement accounts

Taxonomies

Assets are automatically organized into categories, industry sectors, and regions of the world. This allows you to check your exposure and returns across these classifications. You can edit these assignments and their structure if needed.

If you add any custom assets, you can assign them to the same taxonomies or create new ones to compare your custom assets with the rest of your portfolio.

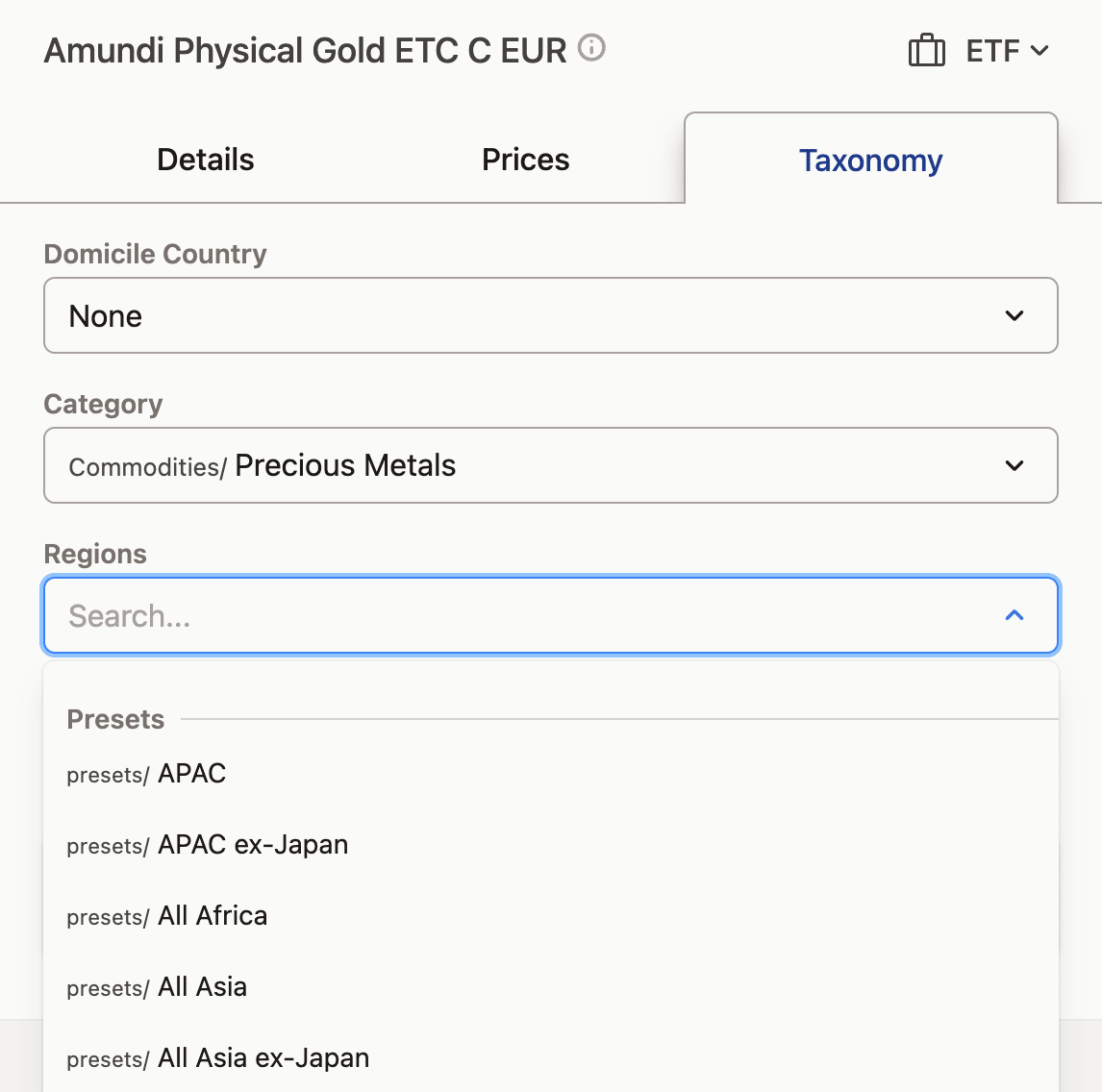

You can edit any asset taxonomy, and use presets for regions or specify your own mix

You can edit any asset taxonomy, and use presets for regions or specify your own mix

The category taxonomy is probably the most useful, as it lets you break down your assets into subcategories like growth stocks, rental real estate, different kinds of deposits, and so on. Since an asset can only belong to one category, its allocation and performance results can be accurately attributed, which is not the case with sectors, regions, or tags.

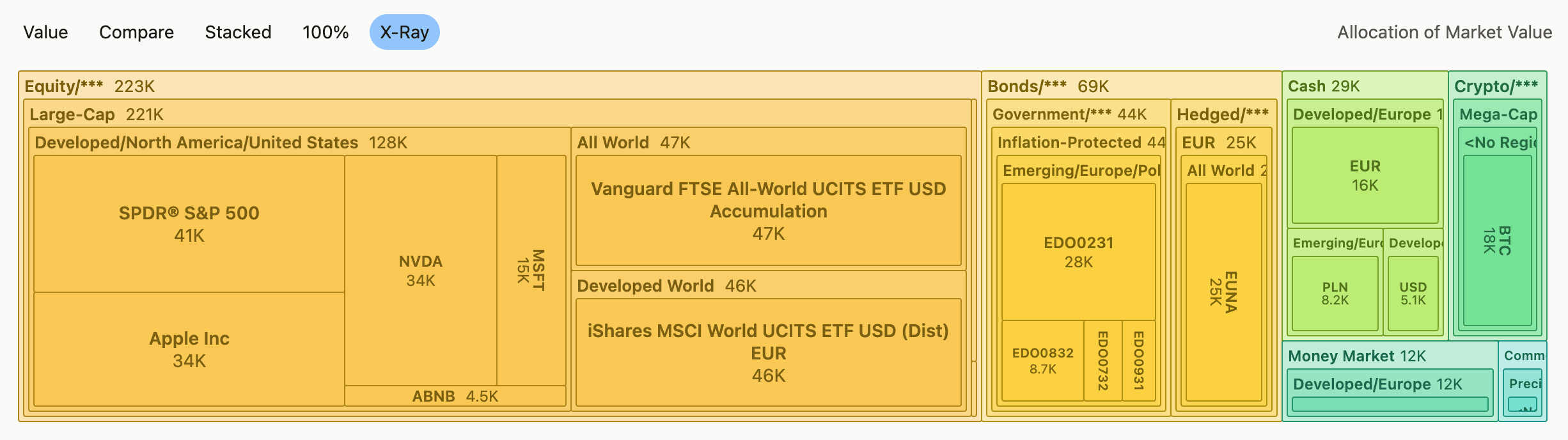

X-Ray chart showing category & region breakdown of the whole portfolio

X-Ray chart showing category & region breakdown of the whole portfolio

Tags

In addition to the organization methods we've covered, you can also use tags. Tags allow you to group accounts, assets, and particular position units together. Tags can be nested and used in many ways.

Tags from all levels (account -> asset -> transaction) are merged together. If you set a tag on an asset or account, all transactions belonging to that account or asset will inherit that tag.

All levels use the same set of tags, so you can apply them at the level that makes the most sense. For example, a strategy tag can be used for an entire account, a single asset, or just a single Buy transaction.

Here are a few examples of how you can use tags:

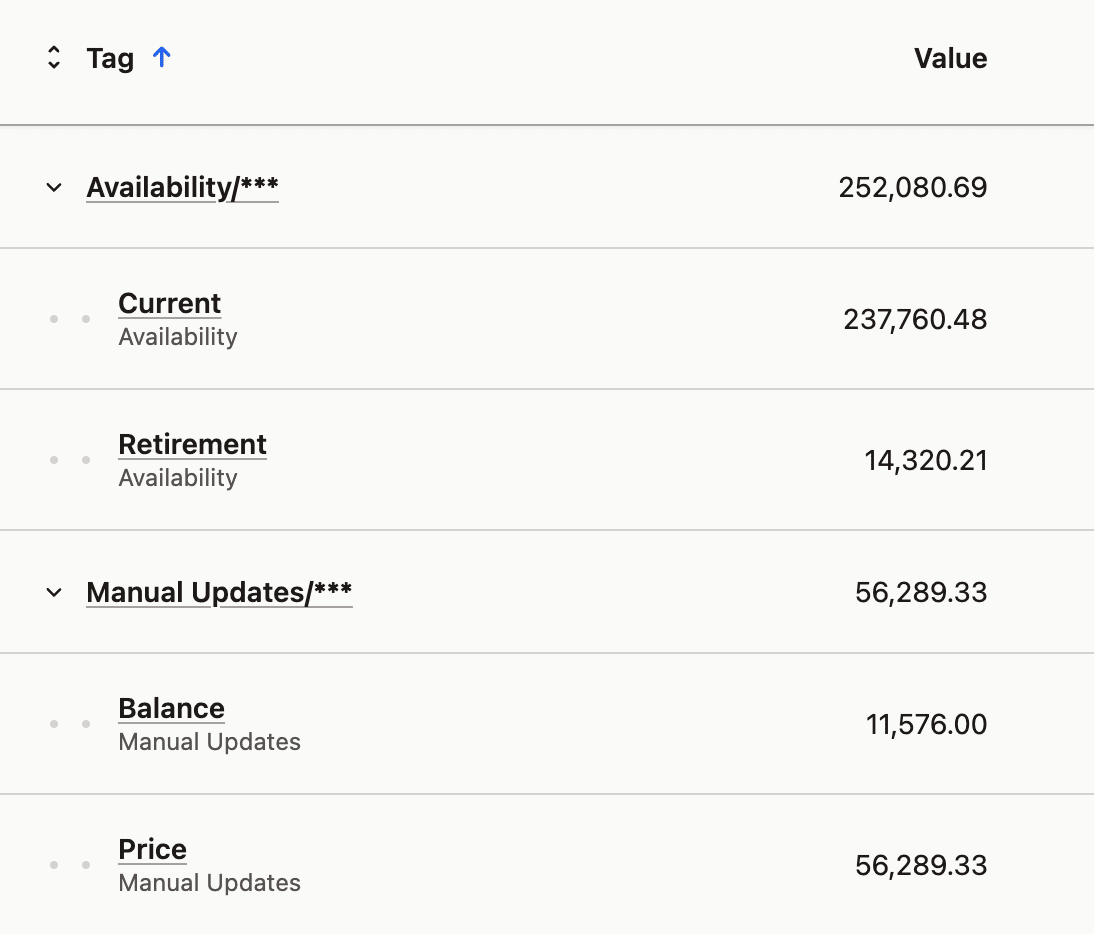

Tracking Liquidity:

Availability/Liquid,Availability/Hard to sell,Availability/Frozen,Availability/RetirementInvesting strategy:

Strategy/80-20,Strategy/Golden Butterfly,Strategy/YOLOOwnership:

Owner/Me,Owner/PartnerPositions needing manual updates:

Manual updates/Account balance,Manual updates/Market priceOptimal closing price (for position):

Close/Above/120,Close/Below/80Additional tasks (for position or transaction):

Tasks/Confirm,Tasks/Close by end of year

Tags can (and should) be nested

Tags can (and should) be nested