This report displays the output of your Tax Presets. It requires the presets to be set up, accounts to be assigned to them, and taxable transactions to occur.

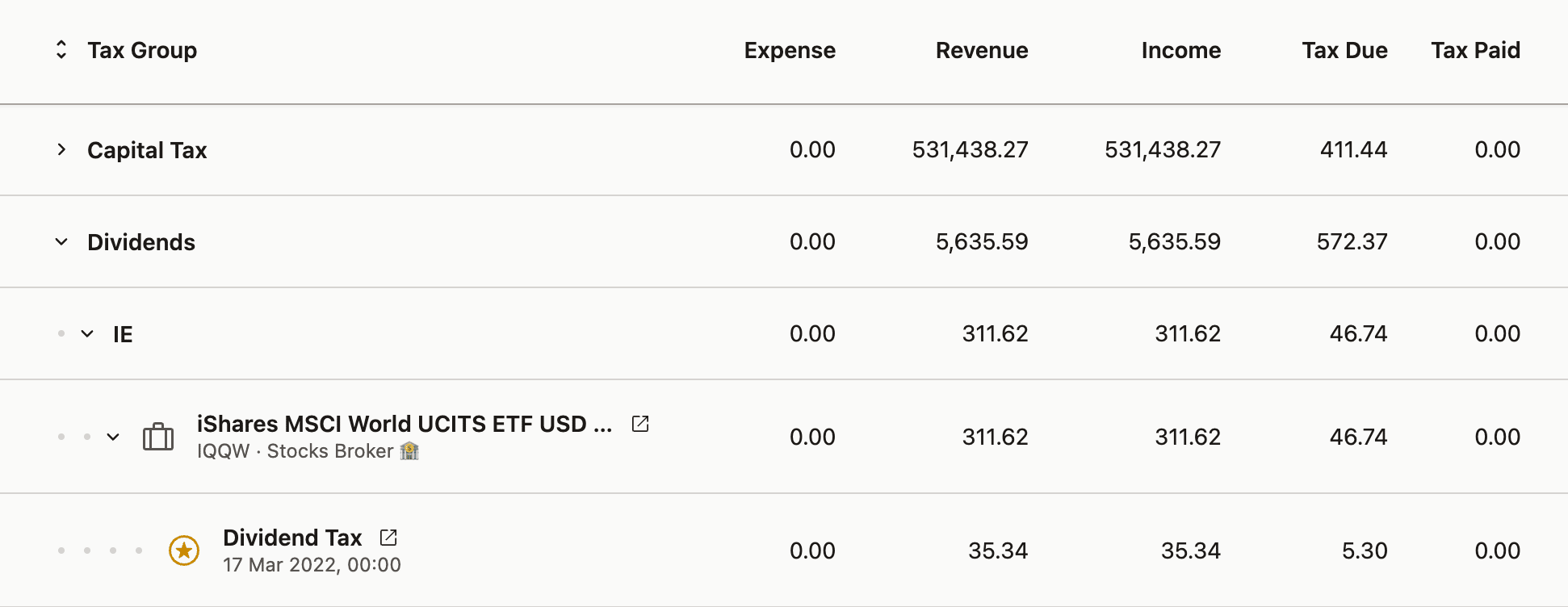

The metrics are grouped by the Tax Group specified in the preset for a particular transaction. Tax groups can be nested by using a / in their name. In the example below, dividends use the Dividends/IE group.

To better understand where specific numbers are coming from, you can expand the groups further to reveal the positions and individual transactions that were taxed.

Please note that taxes are applied to Position Units, which means that a single transaction can be divided into smaller fractions, particularly when a Sell transaction closes shares with varying cost bases. These fractional transactions will have a badge next to their name indicating the fraction they represent.