Transaction is an event that changed the Asset Position's quantity, return or cost.

This guide will walk you through the different transaction types and how to use them.

Transaction Types

Buy and Sell

Use the Buy and Sell transaction types when you purchase or sell an asset in exchange for currency. This also applies to cash transactions, such as buying cash at a currency exchange. For the sake of accuracy, you always need to provide the price per unit you've paid or received.

Transfer

The Transfer transaction type is used when an asset is moved in (positive Quantity) or out (negative Quantity). This could occur when you transfer shares between brokers or receive stock as an employee.

In terms of cash, an incoming salary or outgoing payment for an asset can be recorded as a transfer.

Each transfer can have a cost-basis assigned to it for accurate return calculation. If you skip this step, the closing-date market price will be used to calculate it.

Convert / Move

Use Convert transaction whenever you need to convert or move an asset within a portfolio. For example in cases of:

ticker change

company mergers and spin-offs

crypto migrations

broker-to-broker transfers

It can be used for cash conversions, but it's actually better to just use Buy in these cases instead.

By default, conversion will not realize any returns, forwarding the converted position's cost-basis to the new position. This may make the individual return rates "funny", as the source position looses all it's profits/loss in a single day, and the new position start immediately starts with a profit/loss. But if you look at both assets at the same time, the return rates will be continuous.

Dividend, Interest, and Rent

These transaction types record the fixed income you received. It will be calculated as a separate performance metric, so it should be used only for income that is repetitive and on a more or less fixed schedule, like stock dividends, deposit interest coupons or real-estate rent paid to your account.

You may specify the income per unit for the record, but the return is calculated only based on the Dividend monetary value.

Other

The Other transaction type can be used to record income, expenses, or fees related to the position that don't change it's size.

Account Balance

This is a special transaction type, which you can learn more about here.

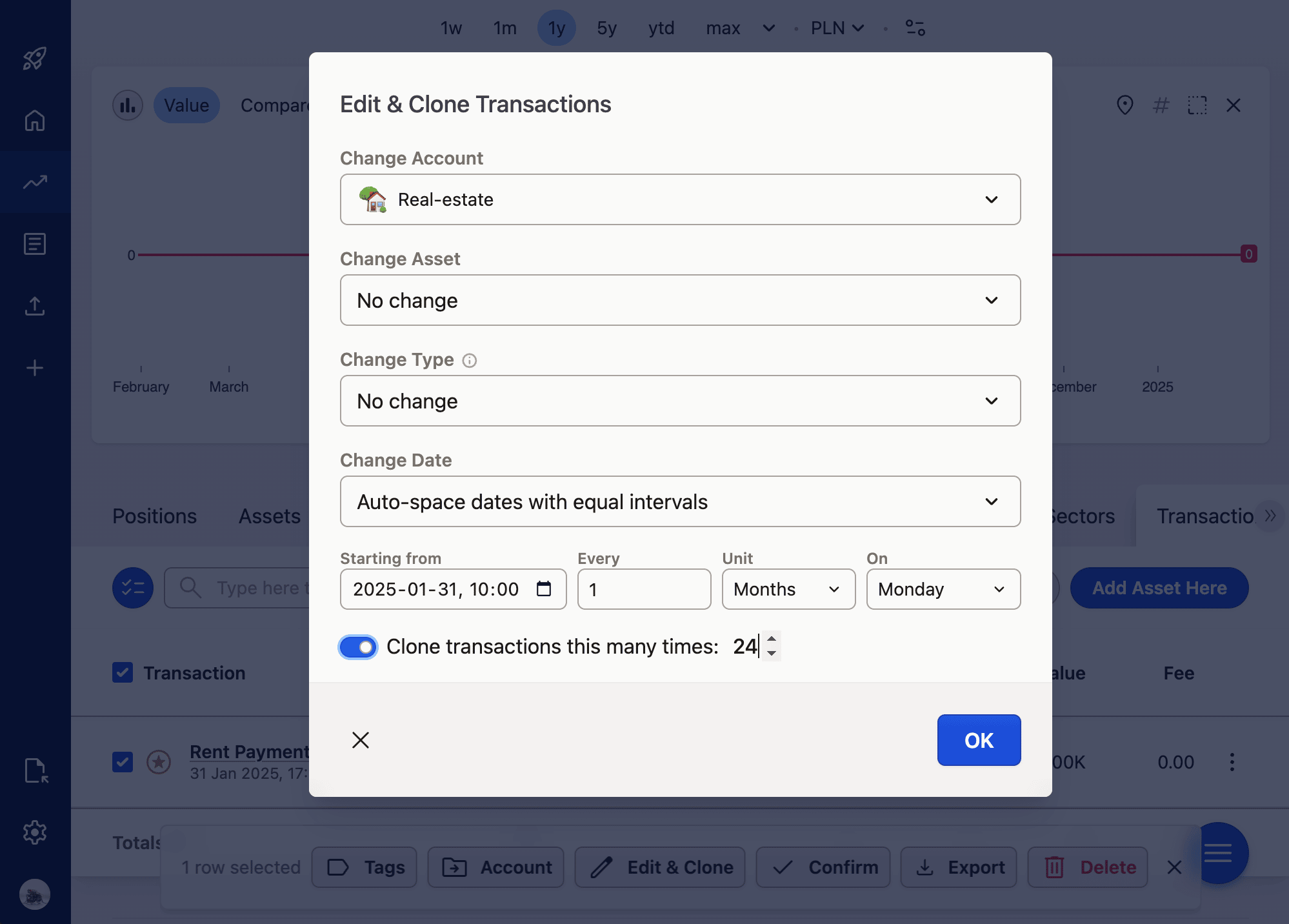

Editing and cloning multiple transactions at once

You can modify and clone multiple transactions by selecting them and choosing Edit & Clone from the popup at the bottom.

You can modify Account, Asset, Transaction type and dates.

For dates, you can set or apply relative offset to each part of the date separately - for example to fix timezone discrepancies after import.

You can also clone the same transaction multiple times, which is especially handy when working with recurring transactions like Rent payments or utility fees. In such case, you can auto-space these cloned transactions using a specific interval.

Future Plans

We are continuously working on improving Capitally's transaction model, especially in terms of fixed income, corporate actions, and custom assets.