Capitally has a full support for Dividends and other types of income, like Rent or Interest. You can track them manually by creating transactions, but for most market-traded assets the dividends will be handled automatically for you.

Automatic dividend tracking

Capitally makes tracking your dividends a breeze with its automatic handling feature.

When you open a position in Capitally, the app does the heavy lifting for you. It automatically includes dividend transactions at their execution date for all market-traded assets. If you've set up taxes, Capitally uses the payment date to calculate the tax on your dividends.

Automatic tracking limitations

While automatic tracking is super helpful, it's not perfect. The automatically added dividends won't include tax withholding information and their payment date might differ from when the dividend actually hits your broker account.

If you're using Capitally for tax purposes, it's crucial to either import them from a broker, or manually check them with your broker statements and fix any differences you find.

Setting up withholding tax on automatic dividends

By default, automatic dividends won't have any withheld tax applied. You can configure it by doing the following:

- Edit the Asset or Account where you want dividends reinvested.

- Open the "Positions" tab.

- Set the "Tax paid on automatic income" to required tax percantage.

Avoiding duplicates

If you prefer to add dividend transactions yourself (either one by one or through importing), don't worry about duplicates. Capitally is smart enough to prevent this. Here's how it works:

- Capitally looks at the period between a dividend's ex-date and payment date, plus an extra 14 days.

- If a dividend already exists within that timeframe, automatic dividends won't be added.

- You can manually add dividends at any time. If there are any automatically added dividends that might cause duplicates, Capitally will remove them for you.

Confirming your dividends

Automatically added dividends are marked as unconfirmed at first. Once you've checked that the values match your broker statements, you can confirm them in two ways:

- Individually: Open the transaction modal for a specific dividend and confirm it there.

- In bulk: Select multiple dividends and use the "Confirm" option from the actions menu.

By confirming your dividends, you're ensuring your records are accurate and up-to-date.

Recording dividends paid in shares

Sometimes, companies offer dividends in the form of additional shares instead of cash. Capitally makes it easy to track these types of dividends too. Here's how you can log them:

- Open the transaction editing modal for the dividend.

- Click the option that says

Show more (income in shares) - Enter the quantity of shares you received as a dividend and any leftover cash (also known as residual cash)

Remember: The Dividend Total Value is the overall dividend's market value, regardless of whether it was paid in cash or shares. Make sure you enter this correctly to keep your records accurate.

Reinvested dividends and DRIP

Many investors choose to reinvest their dividends, either manually or through a Dividend Reinvestment Plan (DRIP). Capitally makes it easy to track these reinvestments.

Manually tracking reinvested dividends

- Treat reinvested dividends the same way as dividends paid in shares (see above 👆 ).

- In the original dividend transaction, set the number of shares bought with the proceeds.

- Don't forget to include any leftover cash.

When you track reinvested dividends this way, Capitally opens a new lot. This behaves just like you bought new shares in the same account.

Automating dividend reinvestment

Capitally offers a way to fully automate tracking of reinvested dividends:

- Edit the Asset or Account where you want dividends reinvested.

- Open the "Positions" tab.

- In the "Automatic dividend handling" option, enable reinvesting.

- You can set different settings for each Account & Asset pair as well.

If you choose the Reinvest whole shares option, Capitally will use the dividend to buy full shares. Any leftover cash is recorded separately.

Please note, that unlike some DRIP accounts, Capitally doesn't accumulate leftovers to buy a full share later.

If your reinvestment plan offers a discount on the market price (common in many DRIPs), you can specify a 0-100% discount in the Reinvestment discount field.

Remember, Capitally uses market-provided values for these calculations. These may differ from your broker statements, so it's great to estimate returns, but you have to confirm it with your statements when precision is needed.

Note on Imports

Currently, Capitally's import feature doesn't fully support dividends paid in shares or residual cash. None of the built-in import templates handle dividends completely. But don't worry - we're working on improving this in an upcoming version!

Disabling automatic dividends

While Capitally's automatic dividend handling is a great feature, you might want to track dividends manually or simply not include them in your records. No problem! You can disable disable them for an Asset, an Account, or a specific Asset & Account pair:

- Edit the Asset or Account you want to change.

- Click on the "Positions" tab.

- Find the "Automatic dividend handling" option.

- Choose "Exclude Dividends" from the dropdown menu.

This level of control allows you to customize how Capitally handles dividends for different parts of your portfolio. For example, you might want to keep automatic dividends for most of your holdings, but manually track them for a specific stock or account.

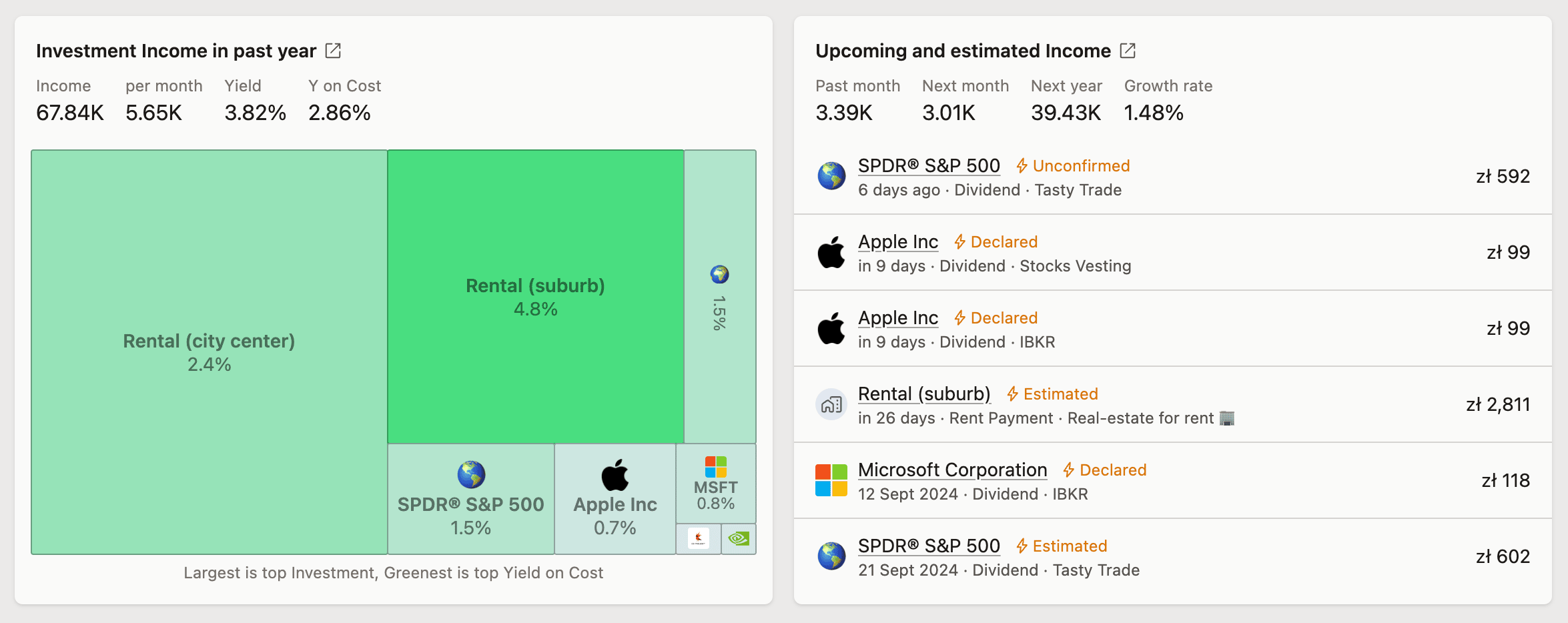

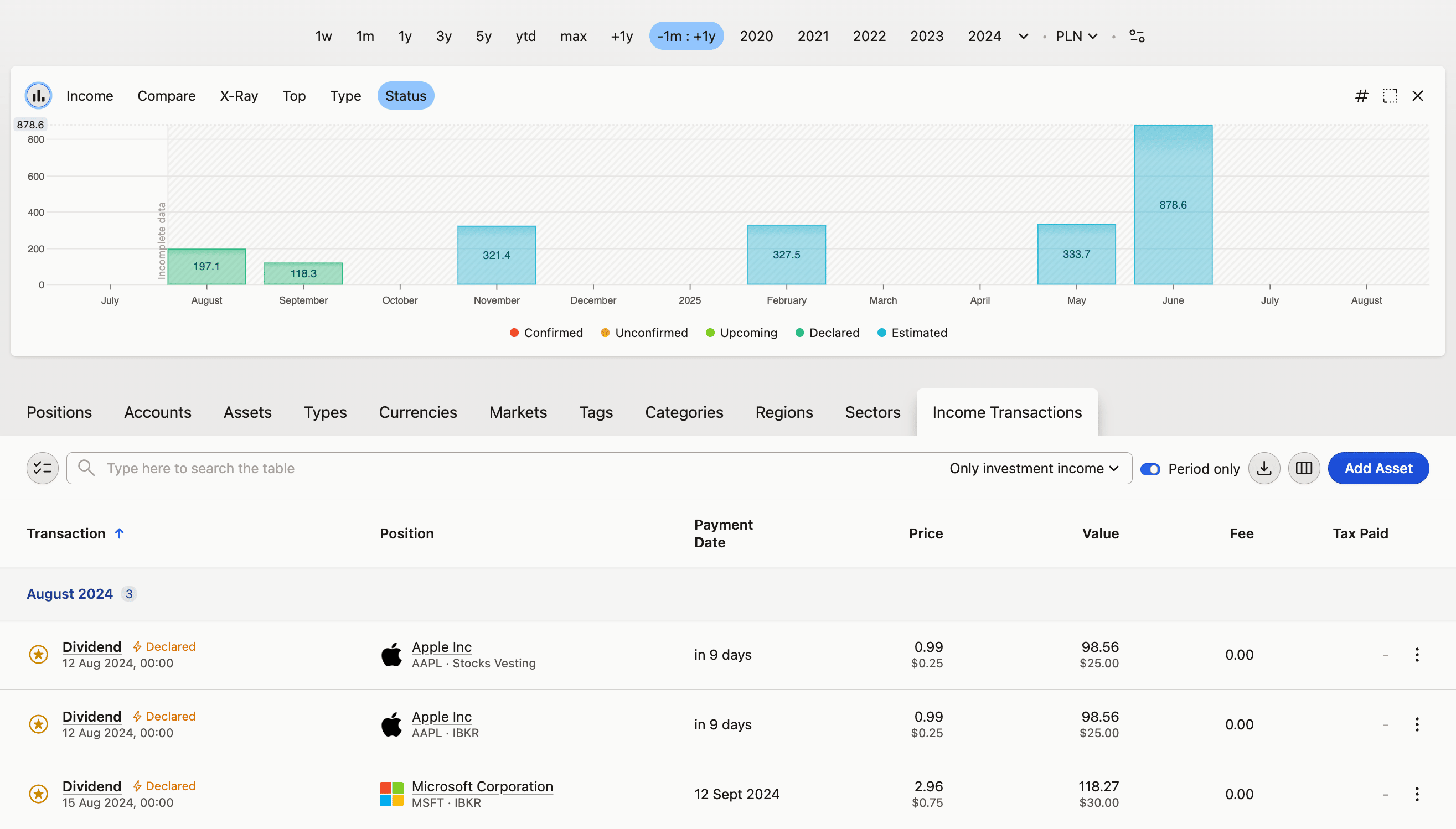

Upcoming and estimated dividends

Capitally doesn't just track your past dividends - it also helps you look into the future. Any future income will be reflected in all metrics, charts and displayed on transaction lists.

To see future dividends, check the widget on the dashboard, or simply select a future date range. For example:

+1y(next year)-1y +1y(from a year ago to a year from now)max +1y(all history plus next year)2023 2025(specific year range)

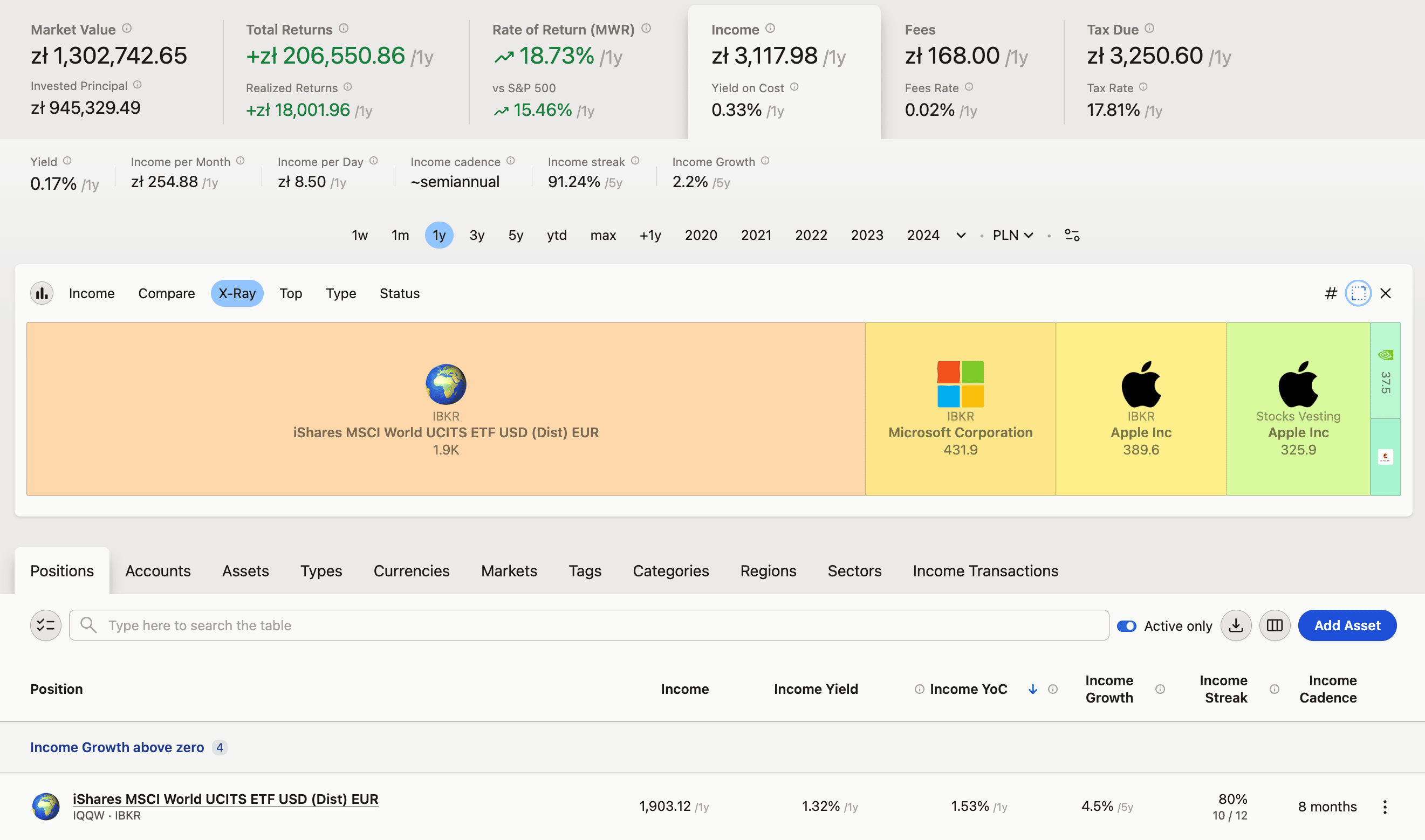

Dividend statuses

Capitally uses the following statuses for dividends:

- Confirmed: Paid out and you've confirmed receiving it

- Unconfirmed: Paid out, but not yet confirmed by you

- Upcoming: Executed and will be paid out soon

- Declared: Officially announced future dividend

- Estimated: Capitally's prediction based on historical data

How future income is estimated?

Capitally uses past income events to estimate future ones. This includes both your project history and market history.

Capitally's estimation engine is pretty smart!

It can detect multiple dividend series for an asset (like quarterly dividends plus yearly special dividends) and estimate them separately.

You can check the metrics in the Income tab that are used as estimation basis: Income growth, cadence and streak.

What Gets Estimated? Dividends and rent income. Dividends are estimated at a price-per-share level, while Rent is estimated at the total value level.

Why estimate rent at total value? Because you usually don't buy or sell parts of a house!

Capitally needs at least three income events of similar size to detect a pattern. It will keep estimating future events unless the last event is more than a month late. For example, if you stop receiving monthly rent, Capitally will wait two months after the last payment before it stops estimating future income from that property.

Remember, while these estimates are helpful for planning, they'renot guarantees. Always double-check with official company announcements or your financial advisor when making decisions based on future income.

Handling dividend taxes

For more general information about tax handling, first check out the article about the Taxes support.

Capitally creates a Dividend Tax event based on two possible dates:

- The

Payment dateof the dividend (if specified) - The

Transaction date(if no payment date is given)

This timing is important because it determines which tax year the dividend falls into.

Tax withheld is not automatically calculated for dividends. You need to import dividends from a broker, or enter this information yourself:

- Open the transaction details for the dividend

- Find the "Tax Paid" field

- Enter the amount of tax withheld by your broker or the company paying the dividend

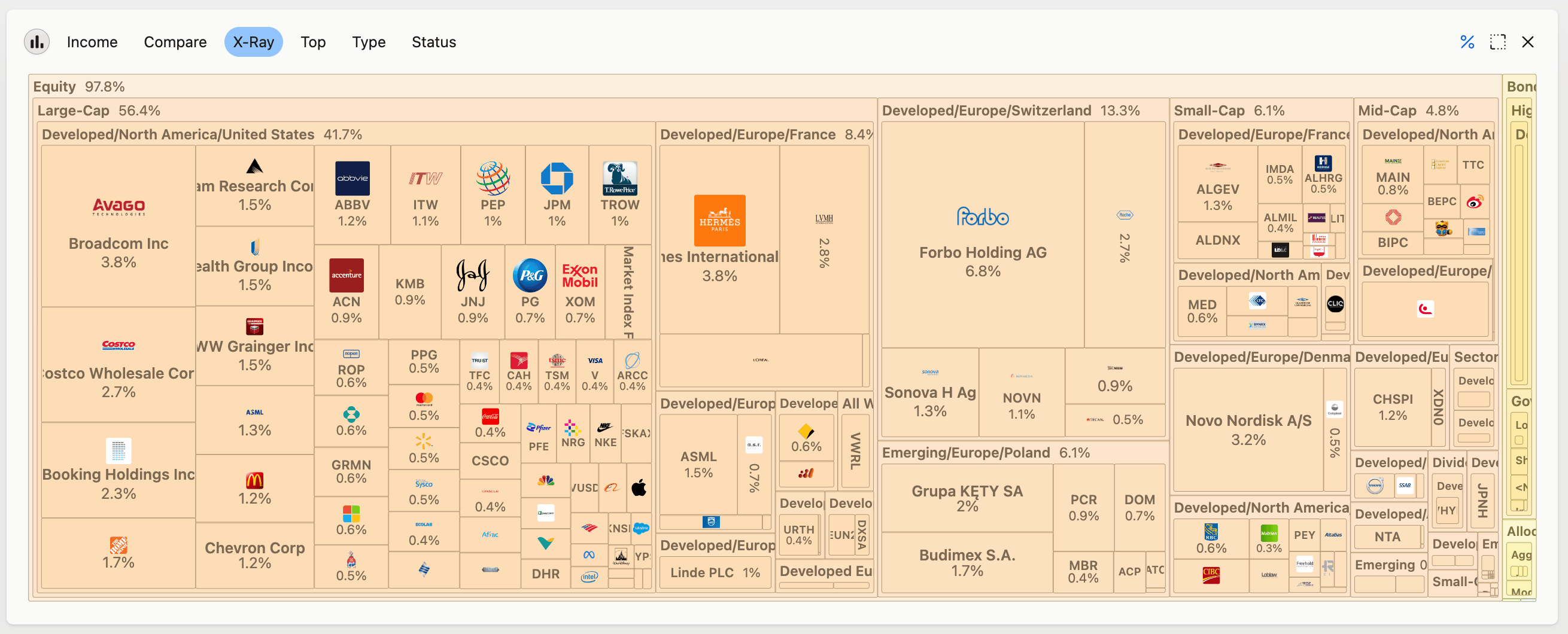

Analyzing investment income

Capitally offers several ways to analyze your dividend income. Let's explore them:

Dashboard includes two widgets summarizing the last year's yield and upcoming income

Dashboard includes two widgets summarizing the last year's yield and upcoming income Income tab lets you explore all relevant metrics and charts

Income tab lets you explore all relevant metrics and charts Income Transactions let's you check specific dividends - both already paid out or estimated to be paid out in the future

Income Transactions let's you check specific dividends - both already paid out or estimated to be paid out in the future X-Ray chart let's you directly compare income from investment types, markets, accounts, you name it

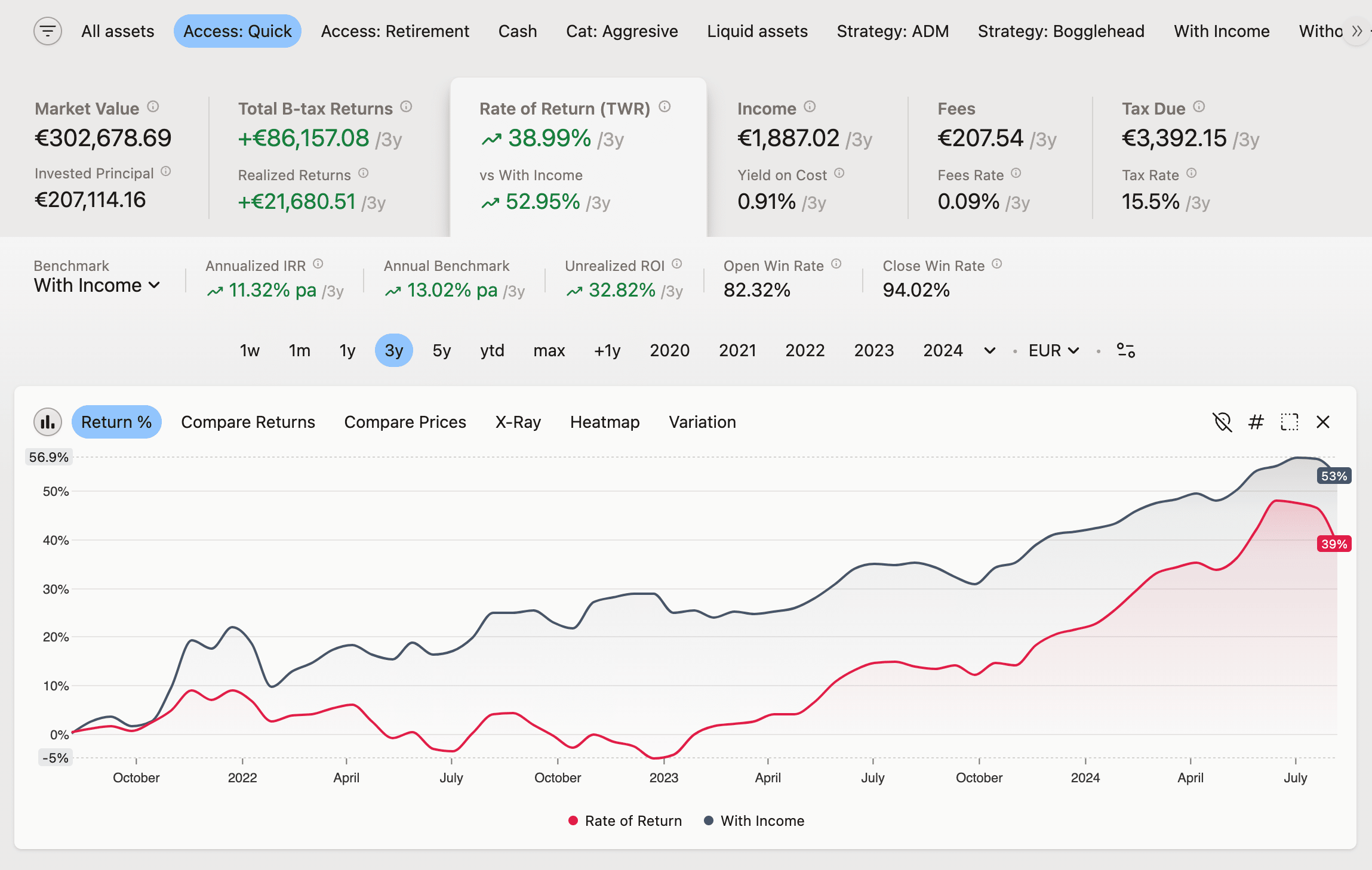

X-Ray chart let's you directly compare income from investment types, markets, accounts, you name it Compare your whole portfolio returns to only those that bring income, by using "With Income" filter as a benchmark

Compare your whole portfolio returns to only those that bring income, by using "With Income" filter as a benchmark

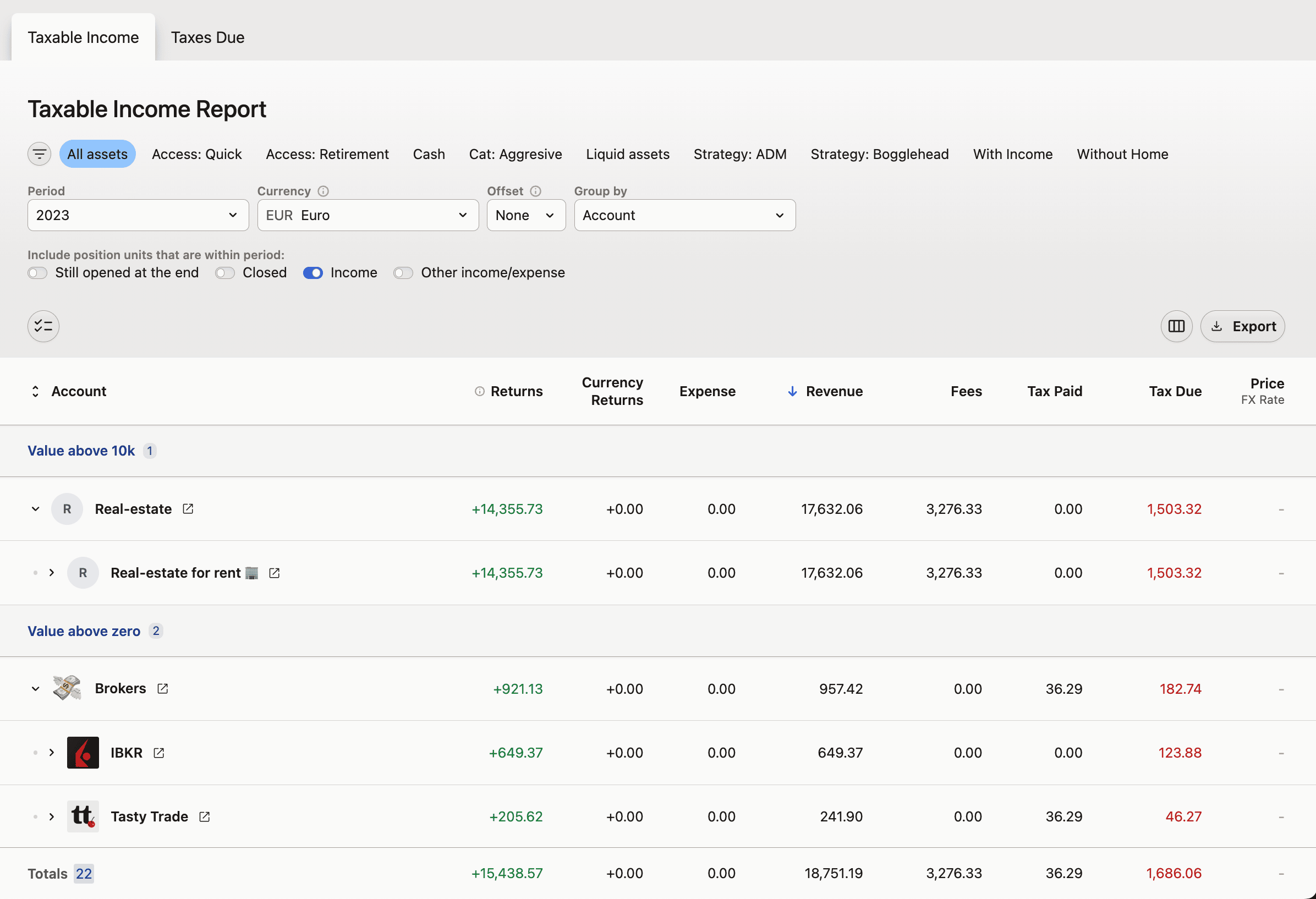

Taxable Income Report let's you create a detailed statement to work with your accountant

Taxable Income Report let's you create a detailed statement to work with your accountant

Other types of income

Capitally recognizes and helps you track other income types than dividends as well. All of them behave the same within the system and everything that applies to dividends applies to other income types as well. Let's look at what else you can monitor:

Real estate rental

If you're investing in real estate, you can track your rental income just like dividends. This feature allows you to:

- Log regular rental payments, along with fees and taxes paid

- Estimate future rental income based on past data

Interest coupons

For investments that pay interest, such as bonds or deposits you can track interest payments.

You can add Interest transactions manually, import them in bulk or setup Interest-based pricing to let Capitally generate them for you automatically.