There are three kinds of taxonomies that Capitally provides for most of the market-traded assets. You have the freedom to edit, expand, assign these to your custom assets, or even change the default assignments to better suit your portfolio needs.

Category

The category taxonomy is a nested set of investment categories such as Equity/Large-cap or Bonds/Government/Short. Each asset can be associated with only one category.

Stocks and Crypto are assigned to a proper *-cap category, unless we don't have market cap information.

Categories are nested with increasing specificity. Meaning, that Bonds category may contain any type of bond (or a mix of them), Bonds/Government narrows down to government bonds of any maturity, and Bonds/Government/Short is the most specific. We don't always have enough information to assign the most specific categories.

Note about nesting

Assets can be assigned to either Bonds or Bonds/Government, depending on category specificity. If you choose the latter, the asset will not be included in the former.

If you want to summarise all of your bonds, look at Bonds/***, as it will include Bonds and any nested categories inside it.

Regions

The regions taxonomy is a nested set of world regions, like Developed/North America/United States. Each asset can be associated with multiple regions and weighted accordingly. The classification follows the MSCI model.

Stocks are assigned to their country of origin.

ETFs and Funds are assigned to multiple broader regions, like

Developed/Europe(with the exception of US, Canada, UK and Japan).

Note about weights

As an asset can have multiple regions (or sectors), it's important to remember that it's impossible to properly attribute returns to just one region.

If you have an asset of 50% US + 50% Europe, that has $1k of returns, we will attribute $500 for US and $500 for Europe. In reality, the attribution may be widely different. We'll show you a warning if results you're looking at are partial like that.

Region Category

To address the attribution issue, assets are also assigned to predefined Region Categories, such as All World or APAC, with each asset belonging to only one class. This classification provides non-partial results that can be benchmarked.

Assets are assigned to a class if their region weight matches the class within a ±10% precision.

Predefined classes use MSCI World as a reference for allocation.

If no class matches, the region or combination of regions covering at least 90% of the weight is used.

Examples

All World: ETFs or Funds tracking the MSCI World allocationDeveloped World: ETFs or Funds tracking MSCI World allocation, excluding emerging marketsDeveloped: ETFs or Funds with at least 90% in developed markets (but not matching MSCI's Developed World)Developed/North America + Developed/Europe: ETFs or Funds that combine North America and Developed EuropeDeveloped/North America/United States: Predominantly US-based Stocks, ETFs, or Funds

Sectors

The sector taxonomy is a nested set of sectors and industries, like Communication Services/Entertainment/Movies & Entertainment. Each asset can be associated with multiple sectors and weighted accordingly. We utilize the industry-standard GICS classification with minor adjustments to better fit the assets tracked in Capitally.

Stocks and cryptocurrencies are assigned to a specific sector and industry.

ETFs and Funds are assigned to broader sectors, such as

Communication Services.

Most assets should have the correct taxonomies assigned, but if the data is missing, inaccurate, or not as you'd expect, you're free to make changes to any asset!

Updating Remote Assets

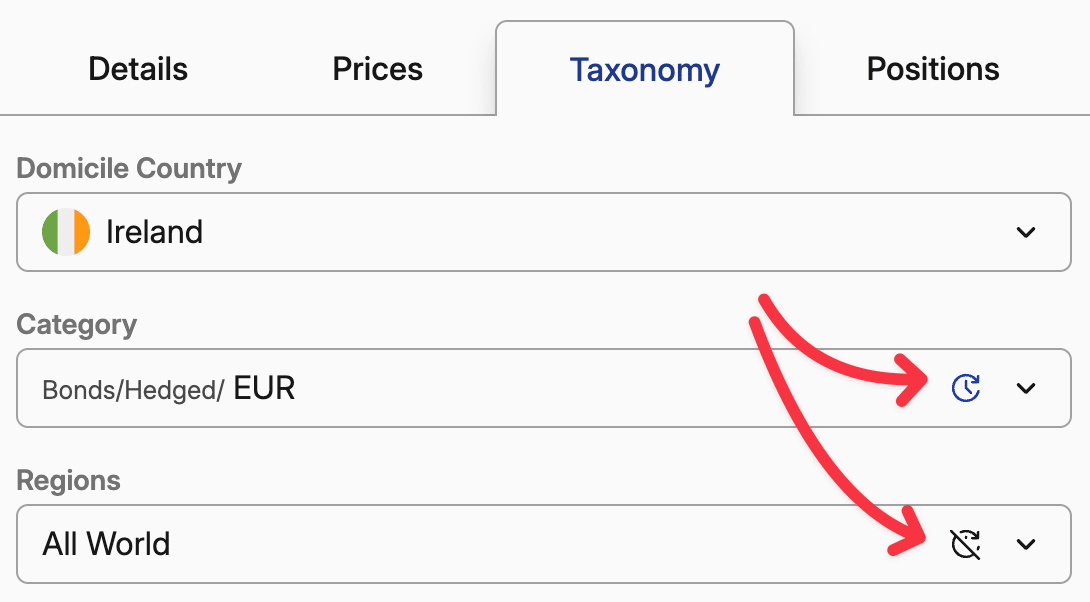

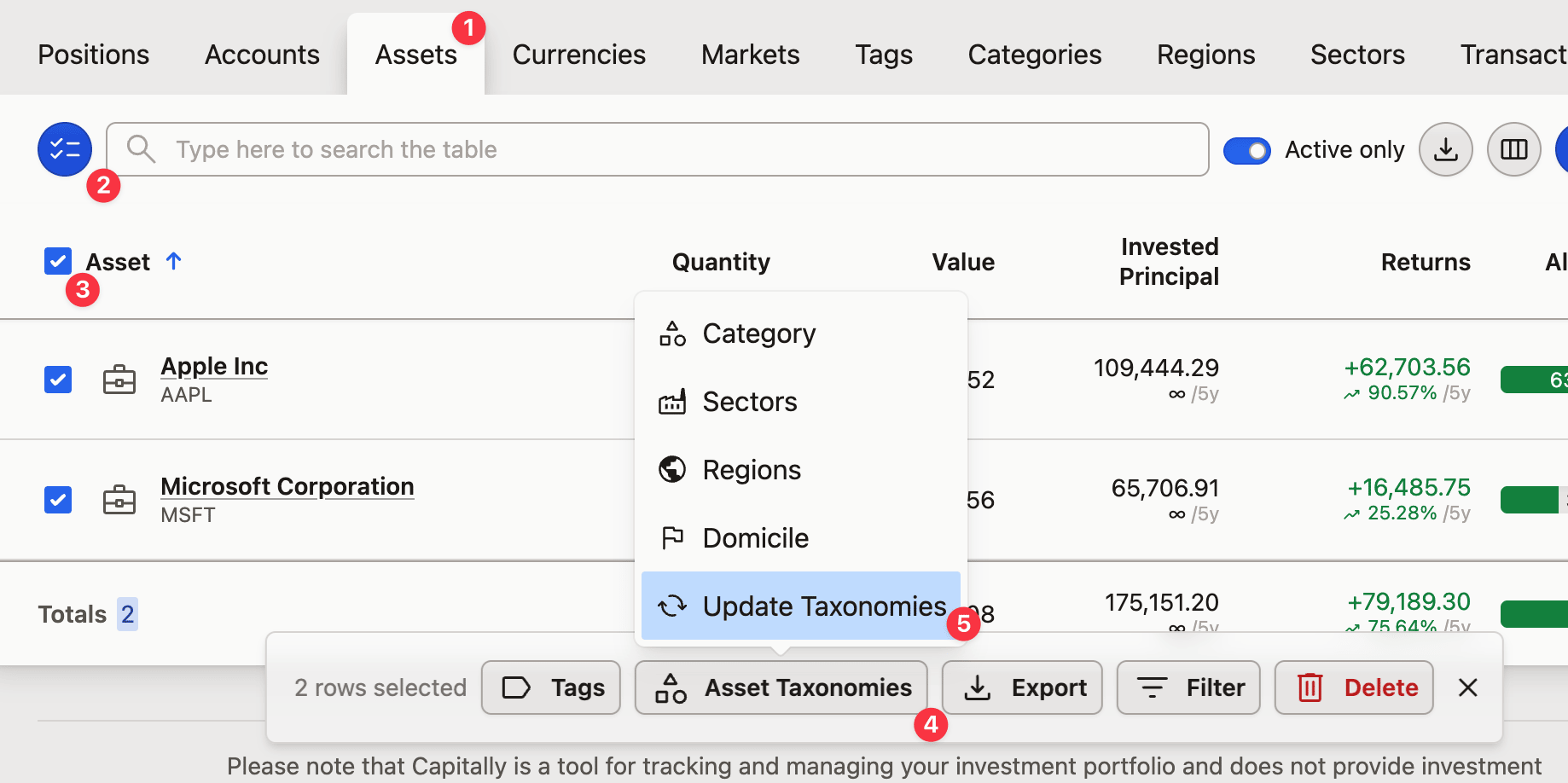

Taxonomies are updated automatically every few days, unless you disable automatic updates in Settings -> Analysis or disable auto update of a particular taxonomy.

You can choose which taxonomies to update, and which you want to set manually

You can choose which taxonomies to update, and which you want to set manuallyAt any point you can update them manually. Simply open the Portfolio, navigate to Assets, select the assets you want to update and click "Update Taxonomies" from the Asset Taxonomies menu.

Note, that if you chose to disable a taxonomy update - it won't be updated through Update Taxonomies.

Editing taxonomies

To edit a taxonomy, open it in Portfolio and click the ✏ Edit button. You can rename it or reorganize the structure within the tree.

If you rename a predefined taxonomy, like Bonds, any new assets you add will adopt your renamed version, allowing you to customize your organization method.